The word “inverted” has been tossed around in the media lately. If you’re a Top Gun fan, this word might have you reminiscing back to what some considered Tom Cruise’s Hollywood heyday, but what the media is referring to is less cinematic. In the financial news, they’re talking about the inverted yield curve.

To watch my video on this topic, click on the image below:

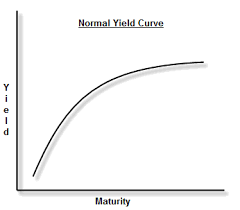

The Typical Yield Curve

A yield curve inversion occurs when shorter-dated Treasuries yield more than longer-dated treasuries, which is somewhat unusual. It’s much more typical for the yield curve to slope upward with yields increasing for longer-dated maturities.

To illustrate, let’s take a look at the following chart:

This is an illustration of a typical yield curve. You’ll see that the trend moves upward and to the right. This chart—and long-term bond philosophy—says, “If you’re locking up my money for an extended period, you will have to reward me with a higher interest rate.” In other words, the longer you hold a bond, the more you should get paid for it. This makes logical sense.

So, what does it mean when this curve inverts? It means there are times when you can get paid more for holding short-term bonds than long-term bonds. For example, an inversion on the 2-year/10-year yield curve would indicate that a 10-yr bond might pay you less than the 2-year bond. Again, this is a rare occurrence. It is more typical for the yield curve to slope upward, indicating higher returns on longer-dated bonds.

What Does an Inverted Yield Mean?

While some are adamant that the inversion is a warning sign of a future recession, others say that because of the significant amount of Fed intervention in bond markets, the yield curve isn’t the indicator it used to be. Plus, rising interest rates can put pressure on the yield to invert.

So who is right? Does an inverted yield curve mean we could see a recession in the next 16-24 months? Or was the inversion related to a timing issue that caused a temporary change of pace?

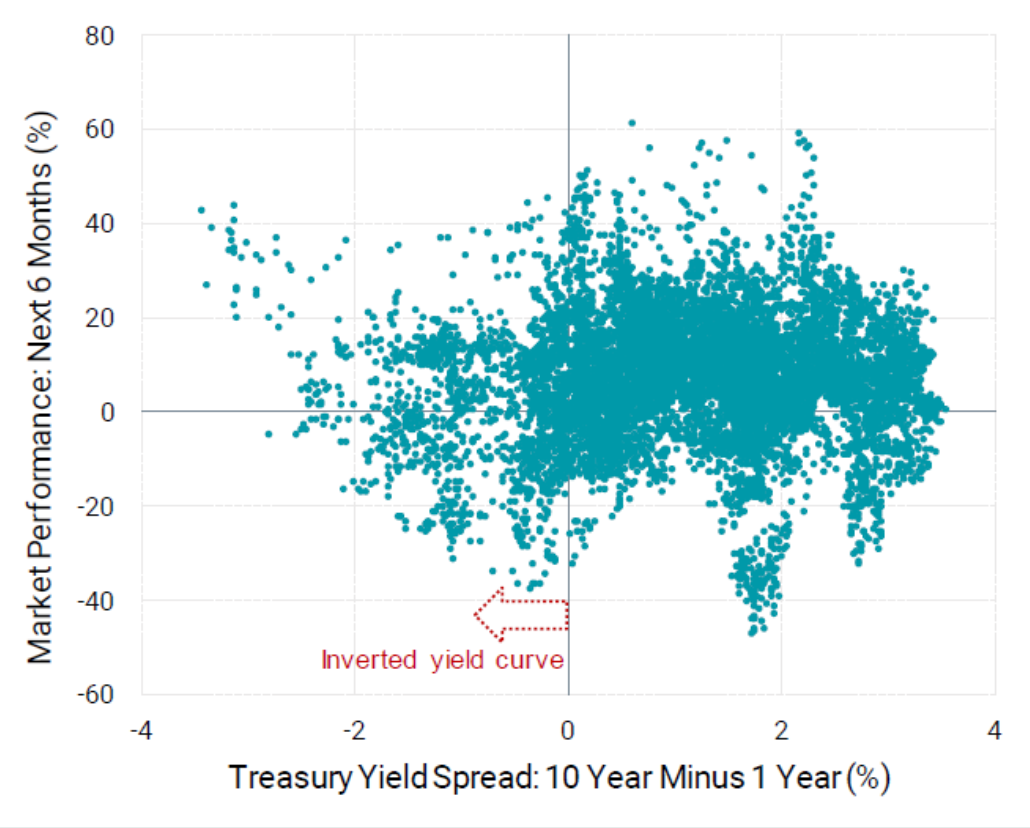

Let’s look at the data. The chart below illustrates what the market has done in the past with both an inverted and a normal yield curve. The dots to the right of the vertical line show you what happens (both positive and negative) when the yield curve is “normal” or not inverted. All the dots to the left of the line show you what the returns do when the yield is inverted.

More dots would be in the bottom left corner if the market didn’t do well with an inverted yield curve. But, what you see is there are plenty of dots in the top left, and there are plenty of dots in the bottom left. There’s no discernible pattern in the data that supports that “if” the yield curve inverts, “then” the market will go down, and there will be a recession.

Could it happen? Sure. But it is not necessarily a precursor.

What does an inverted yield curve mean for practical purposes if it doesn’t necessarily predict the future? Well, this could be good news for the everyday investor. With a normal yield curve, you have to hold longer-term bonds to get a decent rate of return. This increases your interest rate risk. If rates rise, the value of the longer-term bond goes down.

But, now, there are scenarios where you can buy short-term bonds, not take a lot of interest rate risk, and get paid more than people buying longer-term bonds.

You must ask yourself then: “Does it make sense for me to be holding longer-term bonds that might carry different kinds of risk if they’re not going to compensate us for taking that risk?”

When the Yield Curve Inverts, Here’s What You Should Do:

(1) Don’t try to predict the future.

(2) Reframe the event as an opportunity to minimize risk and maximize return.

(3) Decide which bond-buying opportunity gives you the rate of return you need for your specific plan and risk tolerance level.

If there is one thing you take away from this article today—I hope that it is this: you cannot rely on a one-size-fits-all approach to investing. Whether you’re investing to generate retirement income or leave a sizeable legacy to your heirs, you have to make the best investment decisions for you and your plan. Not for your neighbor or the analysts in the news.