The investing experience is an emotional one. From extreme highs when the market is doing well to extreme lows when numbers dip, few things can make you more emotional than your money.

The problem is that your emotions can lead you to make the exact wrong decisions at the wrong time, putting your long-term investment plan at risk.

To watch my video on this topic, click on the image below:

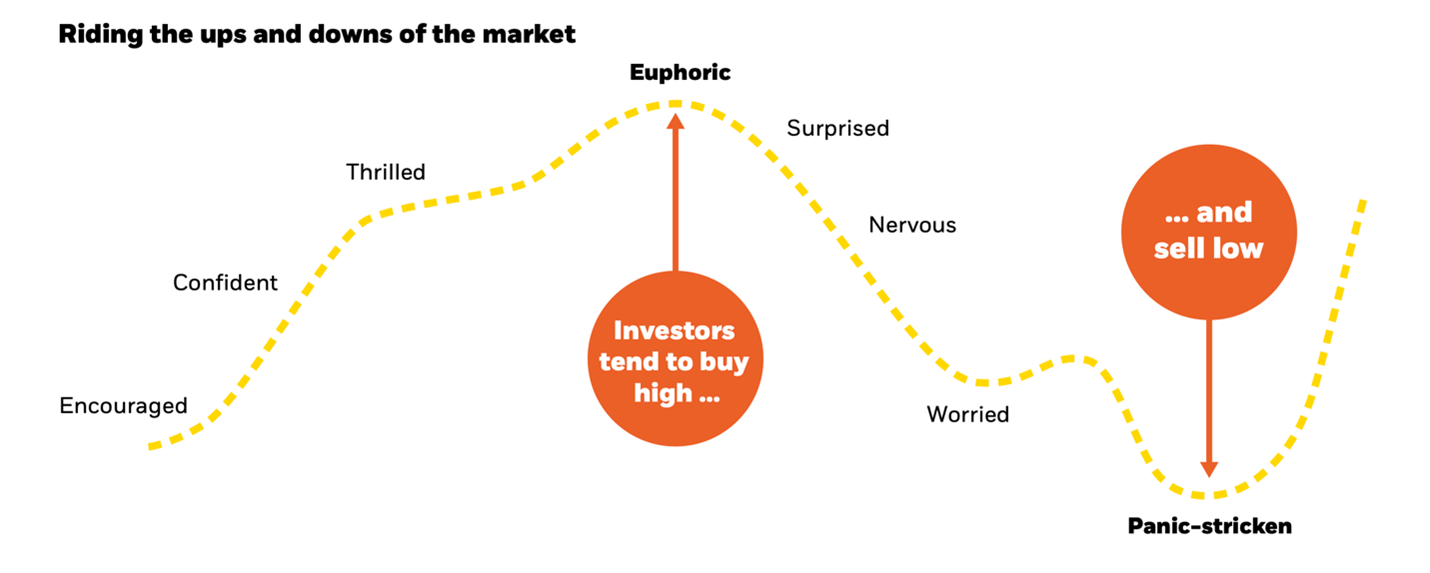

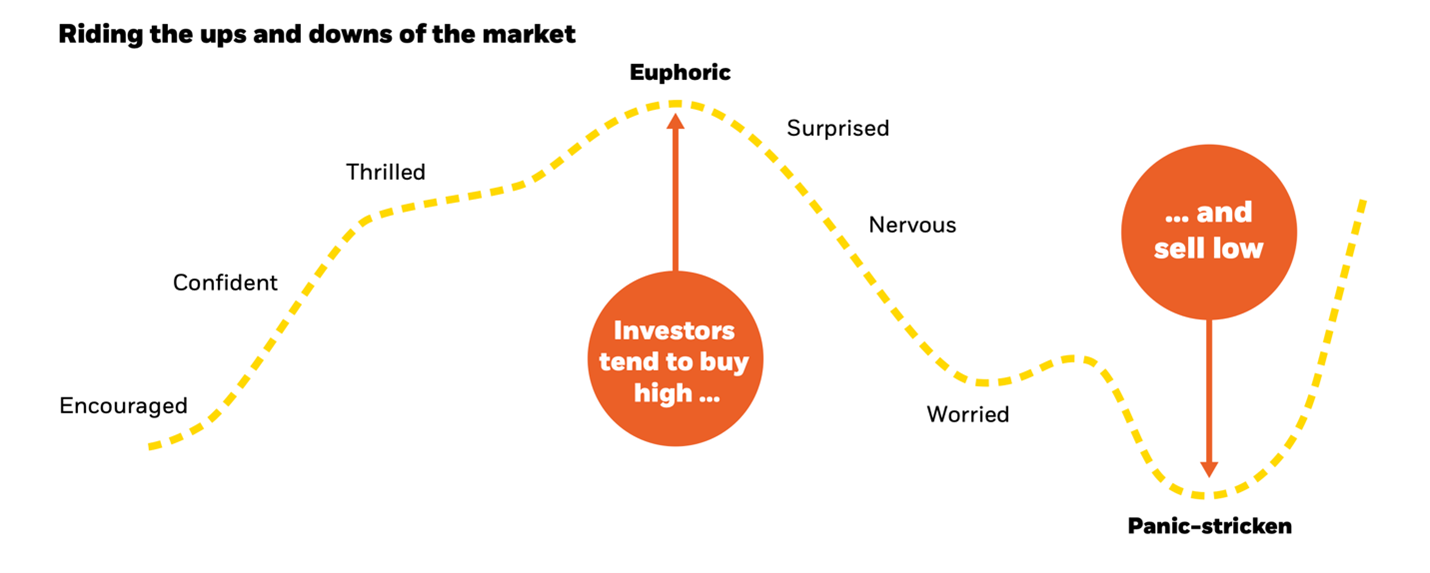

The Cycle of Investor Emotions

Years of research show trends in investor behavior. The trend goes something like what you see pictured below.

Source: Blackrock.com

You feel great when the market is riding high, but you panic as things turn south. Your knee-jerk reaction is to sell to avoid more loss or move into what you perceive are “less risky” investments like bonds.

Unfortunately, these moves (at these times) can cost you a lot of money. Let’s take a theoretical example that reflects the patterns many investors followed when the market dipped in March and April of 2020 and the consequences of those moves today.

The Result of Moving Into “Safe” Bonds vs. The S&P 500 April 2020- April 2022

In April 2020, the market dropped dramatically, and many people were worried. Investors were wondering, “How long is this going to continue? We have a pandemic on our hands, and things are not looking good.”

You could have done a couple of different things when the market dropped. You could have ridden out the volatility where you were, or you could have returned and said, “I don’t think I can take this anymore. I’m going to sit on the sidelines, or I’m going to get conservative until the dust settles. Things look too risky.”

What would have happened to you if you did what many other investors did and sold out of the S&P 500—a “riskier”, more volatile investment—and bought into something perceived to be lower risk, like long-term government bonds? Let’s see.

On April 24, 2020, the S&P 500 ETF was trading at $282 a share, and the long-term government bond was trading at $185 a share.

Since then, the “safe asset” long-term government bond you moved into has gone from $185 per share of that ETF down to $133. Quick math reveals that investment is down about 28% for those safe assets you moved into.

What about the S&P 500 or the stock market you got out of? It went from $282 for the ETF and is now trading at about $452. So, that’s up about 60%.

The “safe asset” you moved into is down almost 30%, and the risky asset you moved out of is up around 60%. The decision you thought was safer ended up costing you a combined 90% difference in return.

How does this happen?

How Can Safe Investments Turn Out to Be Riskier?

You can’t just look at assets in terms of their only risk alone—high, medium, or low. You should consider the price you pay for any given investment. Overpaying for a “safe” asset can make it risky, and buying a “risky” asset at an attractive price can make it safer. Moving in or out of something is sometimes as important as the actual investment. For example, if you move out of something once the price has already fallen, like stocks, the losses have already happened, and some of the risks have already left the market. If you then move into something where you’re looking at high prices—in which case with bonds, when you have low-interest rates, you also have high prices—you find yourself getting out of an asset at a lower price and into an asset at a higher price, which is the opposite of buy low, sell high.

Risk Does Not Exist in a Vacuum

Risk does not exist in a vacuum. To minimize risk, you have to look at what asset you are buying, what price you are paying for it, and how that price will impact your long-term returns. Simply listening to what the popular media or your best friend’s neighbor insists is a safe haven from market volatility will not yield the long-term results you’re looking for to build lasting wealth. Be informed, be intentional, and know-how your investments fit into your long-term plan.

Schedule a call with our founder Kyle Walters today if you would like to discuss the risks involved in changing market cycles. We would be happy to walk you through the role your investments play in your overall financial plan.