To watch my video on this topic, click on the image below:

When it comes to creating your paycheck in retirement, you have several options. Some approaches offer distinct benefits.

For decades, investors have used dividend investing in creating a retirement paycheck. Can this be a successful strategy for you?

Why Is Dividend Investing So Powerful For Retirement?

Dividend investing is powerful because of compound interest—the phenomenon Einstein called the eighth wonder of the world. Compound interest refers to the process whereby interest associated with an investment increases exponentially—rather than linearly—over time. In other words, the money you invest today compounds upon itself year after year to yield a higher return the longer it is invested.

What About Bonds?

You don’t just need one year of income for retirement; you need decades of income in retirement. You may be wondering how dividend-investing stacks up against bonds, especially when bond yields are at multi-year lows. Which is the better choice when the dividend yield of the S&P 500 is right in line with the 10-year Treasury yield?

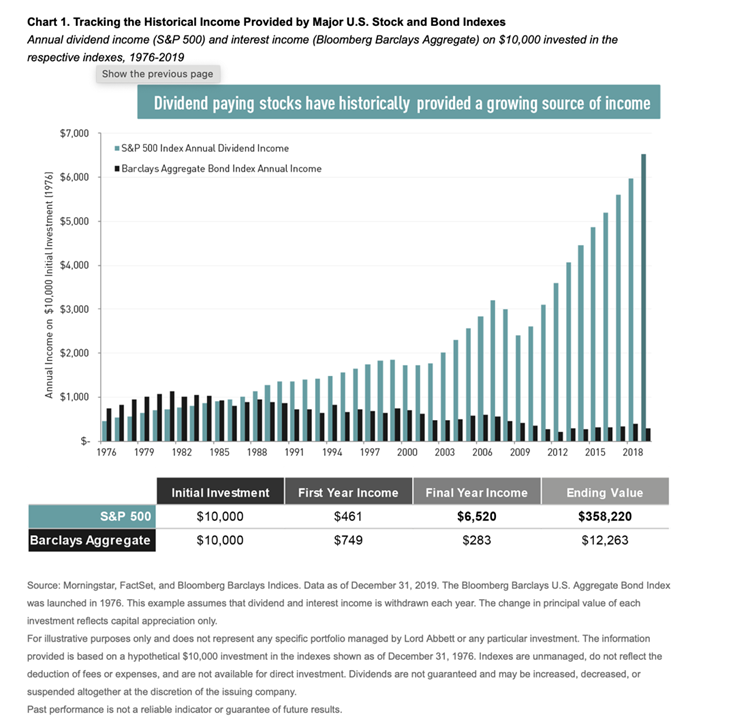

Unfortunately, this is like comparing apples to oranges. Focusing on the current income misses out on the real power of dividends: an income stream that has the potential to grow significantly over time. If we compare the annual dividend income an investor would have received from an initial $10K investment (over the time period from 1976-2019) in the S&P 500 with the interest income he or she would have received from the Bloomberg Barclays US Aggregate Bond Index; we can see the difference.

The bond investment paid a higher income in the first year, but the picture changes over time. As the initial equity investment grew, the annual income from dividends quickly exceeded the income from bonds. And the margins only increased over the years. By the end of 2019, the stock portfolio grew to more than $350,000 and produced more than $6,500 in annual income. That’s more than 14 times the initial income stream.

As for the bond portfolio, over 43 years, the ending value increases less than 1% per year. The income, unfortunately, decreased by more than 50%.

Over long periods, investors have generated more dividend income (from stocks) than interest income (from bonds). For a more detailed discussion, you can view my video here.

So, what are the other benefits of dividend income investing?

3 Major Advantages of Dividend-Investing

The most attractive quality of dividend investing is that you live off the income your stocks are producing without ever having to sell your investments. Because your investments continue to compound throughout your retirement, your annual dividend income can grow, and you still own all your stocks. And best of all, your nest egg is growing at the same time.

Over time, your portfolio with dividend-issuing stocks will:

1) Help Protect Against Volatility: Dividend-paying stocks in the S&P 500 Index have recorded less volatility than non-dividend-paying stocks over the last 47 years.

2) Pay Less In Taxes: A companies’ dividend is likely to be taxed at a lower rate than the same companies’ bond.

3) Provide a Reliable Income: Companies can increase dividends reliably over the long-term and can’t fake dividend payments. Dividends are either paid out, or they are not.

Keep in mind past performance is not necessarily indicative of future results. With a diversified dividend investing strategy, you position your portfolio to deliver a predictable retirement income stream while protecting your long-term purchasing power from inflation and market volatility.

Make Money While You Sleep

The best way to think about dividend investing is to build a portfolio that pays you every day. Instead of stressing over market values (the price of stocks), you can rest easy knowing your portfolio is earning income for you while you sleep. Put it this way: if your 2-million-dollar portfolio generates 3.25% annually, you make $178 a day without lifting a finger or selling any investments.

If you’re interested in learning if dividend investing is right for you, contact our founder, Kyle Walters, here.