The Answer: It Depends

Let me explain.

When we think broadly about different asset classes, most investors are relatively familiar with the big three:

1) Stocks (also called equity)

2) Bonds (also called credit)

3) Real estate

But did you know that you can own each asset class two ways? You can own them publicly, or you can own them privately.

To watch my video on this topic, click on the image below:

But did you know that you can own each asset class two ways? You can own them publicly, or you can own them privately.

Public Markets vs. Private Markets: What Does That Mean?

Companies need money to run their businesses, so they have various options for attracting new investors. The two most common are debt and equity. Equity gives ownership in the form of shares for which investors earn a return as the business grows, and bonds offer credit to those companies in exchange for interest payments.

One of the main differences between the public and private markets is the liquidity of the investment. Publicly traded investments are easy to get in and out of and don’t require a minimum investment, as many privately traded investments do. Private equity is geared toward more sophisticated investors and may be more beneficial for investors who don’t anticipate needing income from their investment in the near term.

How do Different Investment Managers Perform in the Public and Private Markets?

To answer whether or not it makes sense to pay a fund manager to manage your investments, we have to look at how fund managers perform in each class.

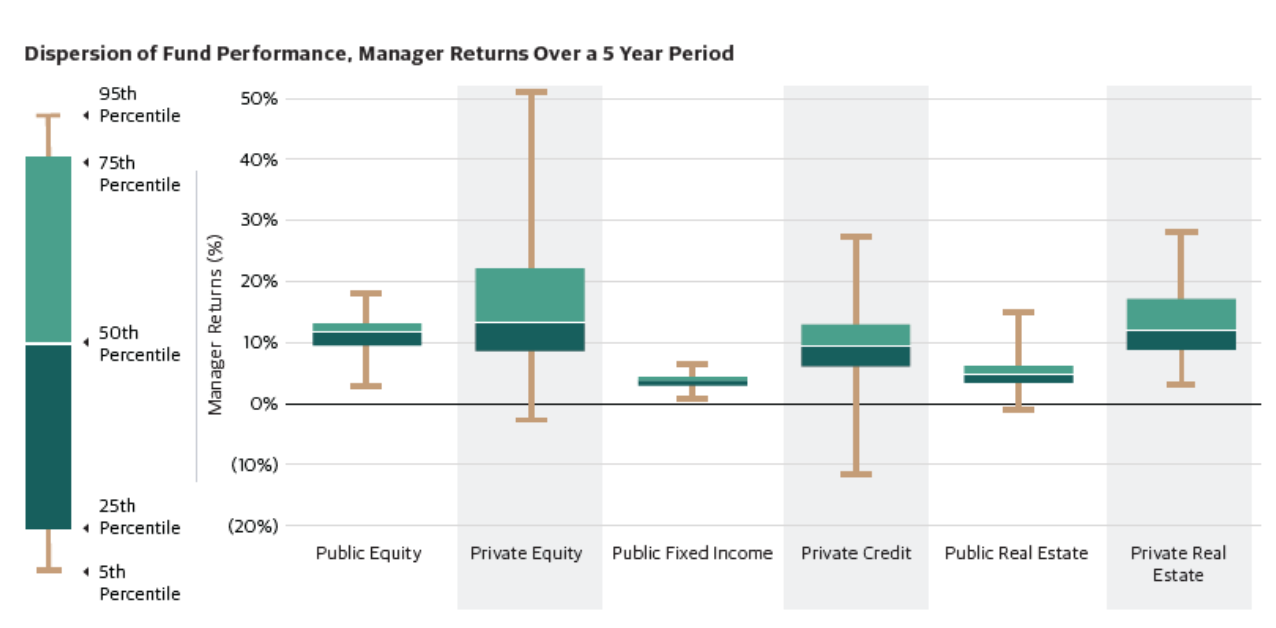

The chart below shows how different investment managers perform with equities, both publicly and privately traded, with credit or bonds, both publicly and privately traded, and with both public and private real estate. The green blocks show where most investment managers return, while the brown lines indicate the entire spectrum, meaning the best performers at the top and the worst at the bottom.

This chart shows pretty consistently on the public side is there’s a difference between the best managers and the worst managers. Still, most of the managers are pretty close to the average rate of return in each class. This is not the case, however, in the private space.

The Story Changes in Private Equity, Credit, and Real Estate

When you move over to the private asset classes, the story changes. The brown line is much longer on the top and bottom, which means there is a vast difference between the good and bad managers in the private space. You could end up with a good manager, and your portfolio would experience phenomenal returns. But pick a bad manager, and that story could look completely different.

Going back to whether or not you should pay an investment manager to manage your investments, you may conclude, “Yes, I should pay a manager in the private space since there are such large discrepancies.” However, the caveat to this is this: you should be very intentional in the manager you choose.

Find a Manager Who is More Than a Warm Body

When looking into private equity investments, it’s not as important to decide to pay somebody as it is to pay “the right somebody.” The best managers are charging you money, and the worst-performing managers are charging you money. They are getting vastly different results; you could either make a very good or very bad investment based on your chosen manager. Over a five-year period, the right manager can mean the difference between a positive 50% (average annual) return down to a negative return (aka loss)!

Not All Managers Are Created Equal

There is a considerable difference between the best and worst managers in the private space. If you’re not sure which one you’re looking at, it may be best to stay out of that game.

There’s a lot less difference in the public markets, so you don’t necessarily need to determine who the best and worst are. Everyone will be pretty close to average (or at least much closer than in the private markets).

Should you pay an investment manager to manage your money?

It may make the most sense in the public markets to keep your costs low since there’s not that big of a difference in the managers’ performance. However, in the private markets, if you can get access to the best and you know they’re the best, you could greatly benefit from making that investment.

Private equity investments can be great additions to many investors’ portfolios when approached with the proper knowledge and goals. If you’re interested in learning how you can further diversify your portfolio in the private space, contact our founder Kyle Walters for a complimentary Introduction Call today.