I have been hearing a big, scary word thrown around a lot in media lately.

To watch my video on this topic, click on the image below:

No, it isn’t “war” or “inflation.” It isn’t “rate hikes” or “taxes.” It’s the word “unprecedented.”

Technically, unprecedented means “never done or known before.” Events or unprecedented situations are without precedent. Of course, this is just another way of saying, “This has never happened before, so no one can confirm what will happen next.”

In the words of Inigo Montoya from The Princess Bride, “You keep using that word. I do not think it means what you think it means“.

If you’ve spent any time on my blog or watching my Personal CFO videos, you know that investors (and by default, markets) don’t like uncertainty. And this is mainly because our instinct to survive fears the unknown. The unknown threatens our ability to predict, shape, and control our destiny. It threatens our survival. And we can’t help it. This reaction is primal.

What better way to get a human’s attention than threaten the predictability of their future?

Mainstream media is great at invoking fear and emotion-based responses. The more attention they can garner, the more commercials they sell.

Why “Unprecedented” Isn’t All That Scary

The news, by its nature, will always be unprecedented. There has never been and never will be another time precisely like the one we are in now. The circumstances surrounding each moment, each year, each decade vary so widely that there is no such thing as history being “precedented” at all.

This is not to say that trends can’t be identified or patterns extrapolated from “similar” events, but these trends and patterns are in no way reliable predictors of the future. Too many external influences are at play at any given moment to make the consequences of any two exclusive events exactly the same.

The word “unprecedented” is not all that scary because tomorrow is always unprecedented. No one, including the media, the pundits, or the economists, knows the future. So unprecedented takes a lot less meaning when you realize that we never know what will happen in the future. That’s why it’s called the future.

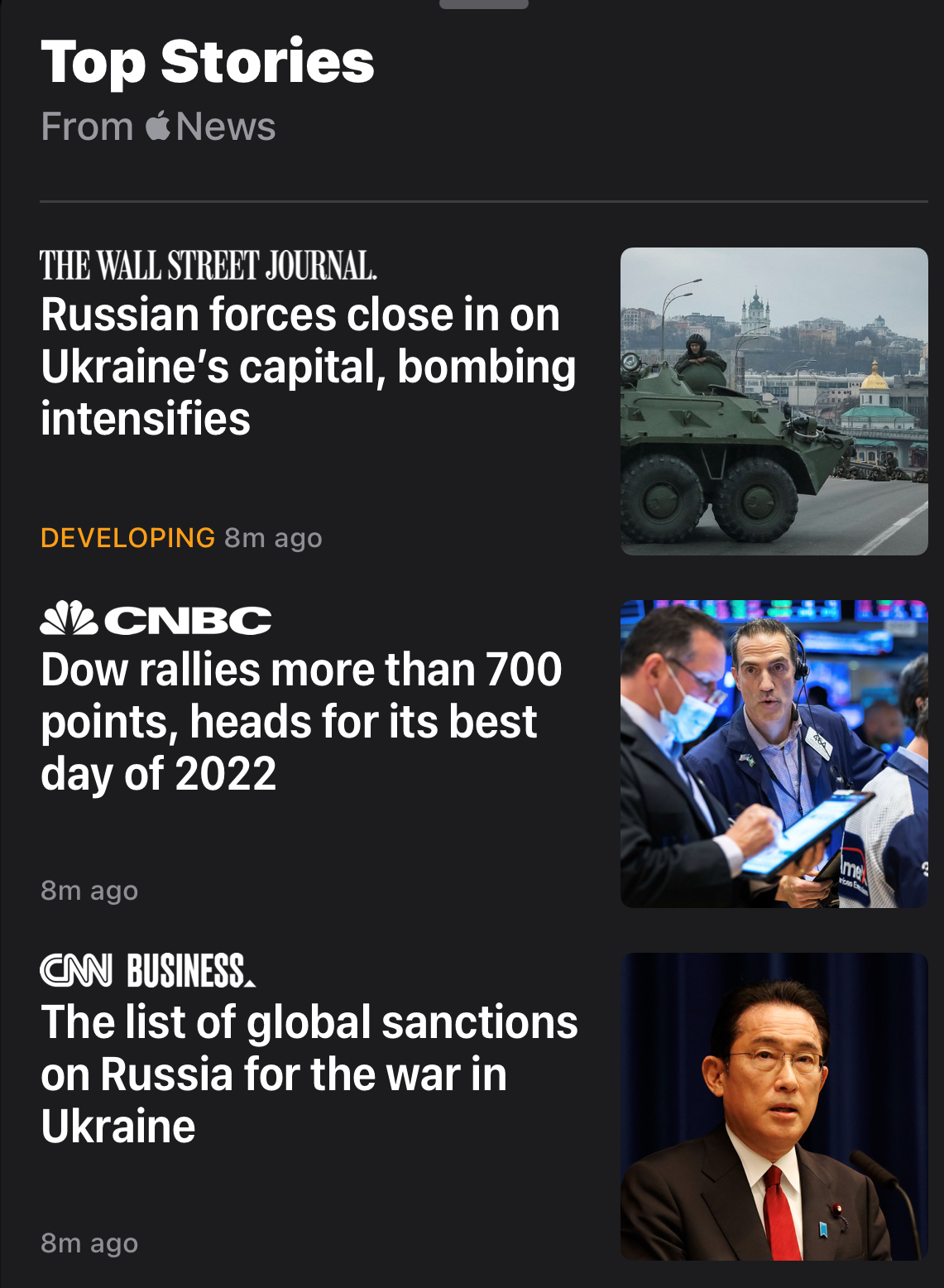

Here’s an example. Imagine we were speaking two weeks ago, and I told you Russia would invade Ukraine. I said, “There’s going to be traumatic bombings, and it’s going to be a terrible human event.” You would most likely anticipate the market doing poorly. Well, what’s happened? Take a look at the photo below from my smartphone.

On top, you see headlines about Russia moving into Ukraine. Bombing intensifies. It looks terrible; We have a war going on. Directly below that headline is another that says, “The Dow is on track for its best day of the year!”

This seems absolutely “unprecedented.” Except here is the thing: It always is.

No Easy Way to Connect the Dots

Trying to connect geopolitical events with the stock market in any predictable way is incredibly difficult. No one has been able to do it. Next time you hear the word “unprecedented” from the media (or other fear-invoking words designed to get you to pay more attention so they can sell more commercials), here is a tip. Focus your attention on your long-term plan and focus on what you can control.

Even though we can’t always predict what the market will do, ups and downs are normal. The most important thing you can do is make sure your portfolio is prepared to withstand any market disturbances—geopolitical or otherwise.