Changes in the price of a stock—also referred to as volatility—can cause a lot of concern, especially when the markets have been relatively calm for some time.

To watch my video on this topic, click on the image below:

At the time of this writing (January 2022), the market is down roughly 10% for the year, and people are asking questions.

What’s with the 10% drop?

Does this mean a more significant correction is on the horizon?

Of course, no one can predict the future, and past performance is not an indicator of future results. Still, some history can help to remind us that volatility is entirely normal and expected. It indicates the markets are operating as they should. Just because we may be pushing through some choppier waters at the moment, there’s no guarantee a recession is around the corner.

Market Volatility is Normal

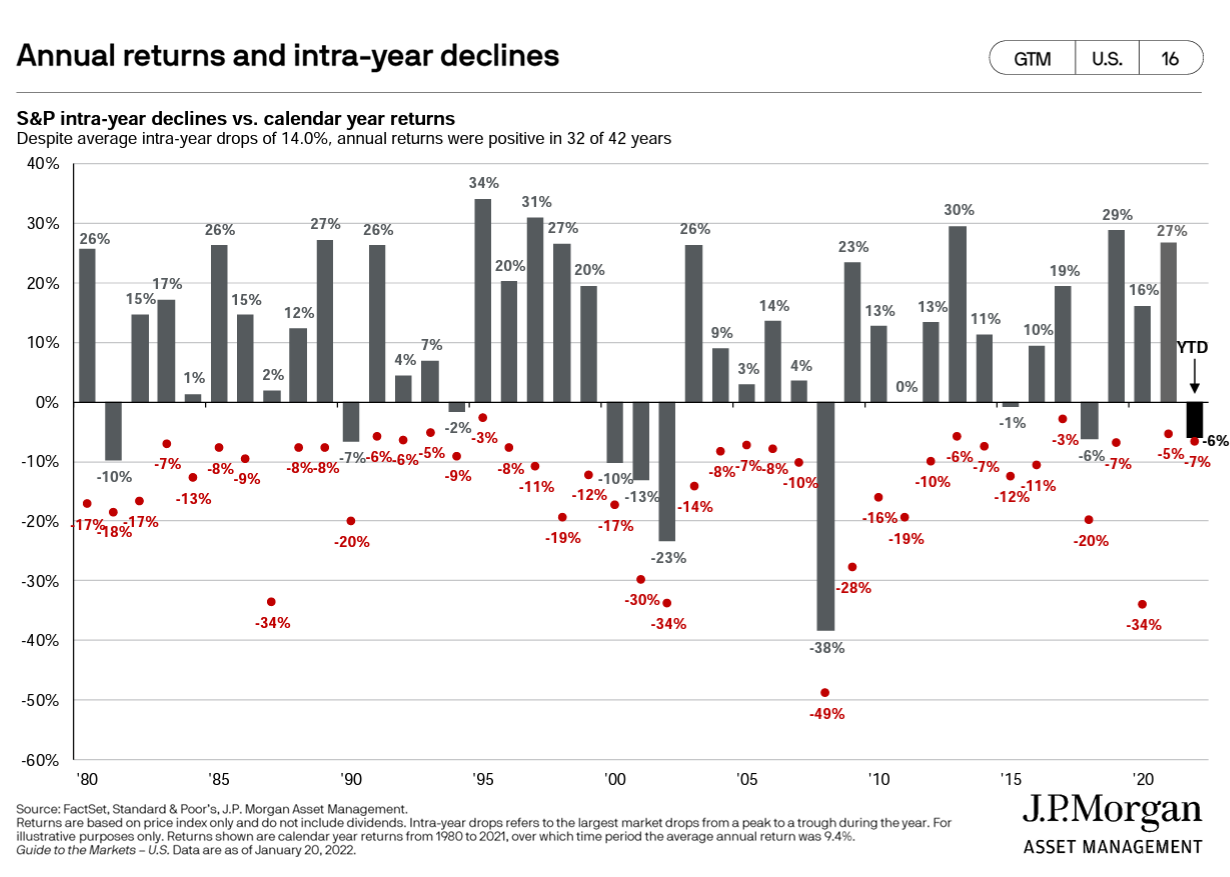

Understandably, the ups and downs of the market may be more challenging to remember. Since March 2020—almost two years ago—we saw very little volatility (see Figure 1 below), and prices have been rising consistently since then.

Figure 1. Annual returns and intra-year declines of the S&P 500 from 1980-present day.

This chart gives you the annual rate of return of the S&P 500 and the intra-year declines the market experienced. The bars reflect the annual returns, which are pointed in the positive direction most of the time. The red dots show you the greatest drop in the market that year. As you can see, there are plenty of times the market averaged over 10%; but there are a lot of red dots, which means the market had plenty of dips. The average dip was over 14%, which means the average downturn on any given year over this period was 14%. But despite the average intra year drop of 14%, annual returns were positive in 32 of the 42 years.

In 2021, however, the greatest drop we saw was only 5%. Can we even call that a drop? Maybe we refer to it as a blip. Here we are in January 2022, and the market is down roughly 10%, which is double the drop we saw last year.

Does that mean the future inevitably holds bad news? No, it does not mean that.

The volatility we have seen so far this year is far from abnormal. It is still below the average dip of 14%. It’s that we have been lucky enough to be riding the wave of a steadily increasing and calm rise in the market for some time now—nearly 24 months.

The takeaway here is that it’s important to keep perspective when it comes to market drops, blips, swings, jolts, or otherwise. What feels like a canary in the coal mine could very well be part of a natural, healthy market cycle. So, if the relative calm of the past two years has adorned you with rose-colored glasses, don’t worry. Ups and downs in the market are normal. More than anything, you need to make sure your retirement plan is prepared for any market.