Geopolitical tension regarding the Russia/Ukraine conflict is heightening each day, and naturally, clients have been asking questions.

To watch my video on this topic, click on the image below:

“With all that’s happening between Russia and Ukraine, what should we do with our portfolio?”

Before I begin to tackle what we can expect as things unfold, I would first like to go ahead and remove the human element from this discussion. This situation has negative human elements, but this article will purely address the stock and economic markets.

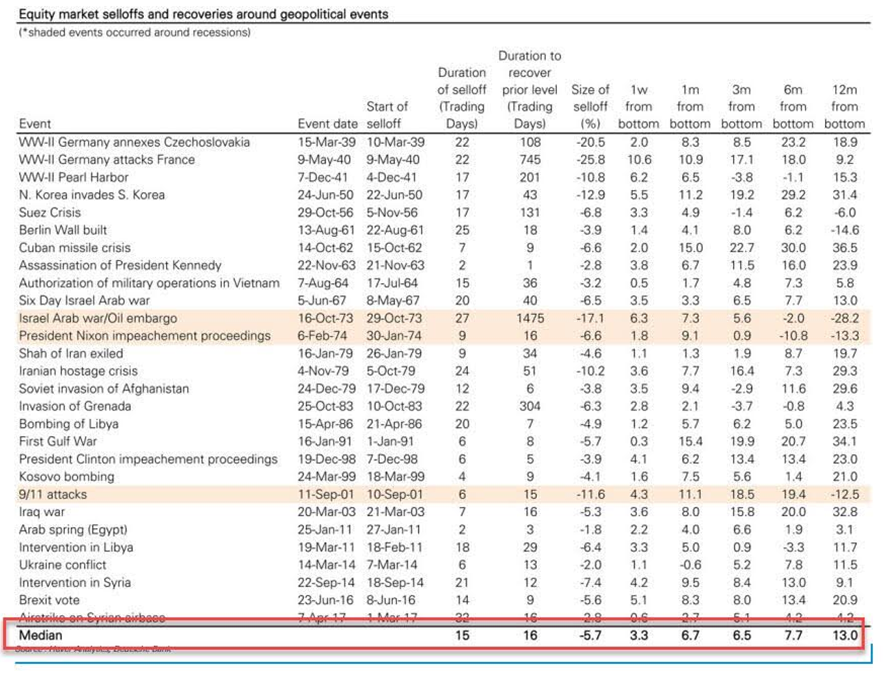

Equity Market Selloffs and Recoveries around Geopolitical Events

Let’s zoom out and look at how past geopolitical events have impacted the stock market to give this some context. The following chart illustrates how markets have reacted in the wake of dozens of other important geopolitical events over the past several decades.

The bottom row of this chart provides a ton of helpful information in understanding the average trends for each category. First, look at the average drop after one of these events: -5.7%. As you move to the right, you can see the recovery rates. One week from the bottom, the average recovery was 3.3%; one month from the bottom, the average recovery was up to 6.7%; and twelve months from the drop, the market was up on average 13%.

Now, consider this. This chart only shows drops that occur around a crisis. It does not account for times that the market didn’t drop at all.

What can we take away from this information?

Volatility is Always with Us, Even When Major Geopolitical Events are Not

When major global events occur, and news stories begin flooding your inbox, you may start to feel a tinge of panic set in. You may think to yourself, “This has never happened before, in my life, so surely there is no way to know what’s going to happen. Maybe I need to move all my assets into bonds or cash to be safe.”

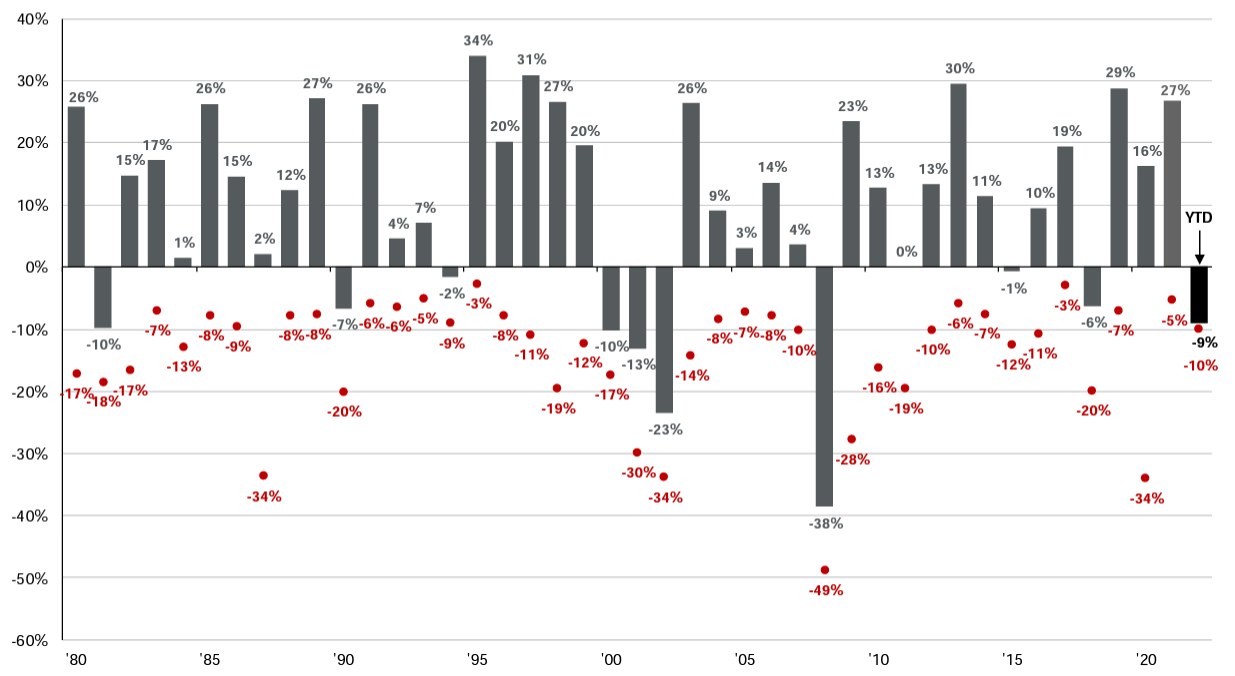

But the reality is that the market experiences bouts of volatility in the absence of geopolitical conflict. The chart below illustrates this point.

As you can see, you have the gray bars going up across the top and the red dots peppered in down below. The gray bars represent annual market returns and the red dots represent the intra-year volatility. You can see that every year going back to the very beginning, volatility has been present. Most of the time, we end up having a positive year in terms of returns. But every year, we see a red dot, which indicates the market drops all the time. Whether or not we have a global pandemic, whether or not Russia invades Ukraine, volatility is always with us.

Volatility is Common and Temporary

These conflicts are not as rare as they may seem, and the market reactions to such conflicts may not be as scary as we imagine. Volatility is with us year after year. The change in stock prices—or volatility—allows us to reap the benefits of investing after all.

As we move forward through whatever may happen in response to this conflict, remember that volatility—whether it’s economic or geopolitical—is common and temporary. The exact details and circumstances may not be identical, but the market is no stranger to these types of minor disturbances.

Remember to focus on your plan and understand what you own and why you own it. If you are interested in learning how Atlas Wealth Advisors keeps you on track through volatile market conditions, we encourage you to reach out and give us a call.