For the better part of this year, consumer confidence has been at a 10-year low. In other words, people are not feeling great about the economy, which is understandable.

Confidence deteriorated last year with the delta and omicron outbreaks, and now rising inflation and the war in Ukraine are adding to that angst. With so much uncertainty taking center stage, it’s no wonder people are having a hard time feeling optimistic about the future.

To watch my video on this topic, click on the image below:

What Happens When the Market Hears Bad News?

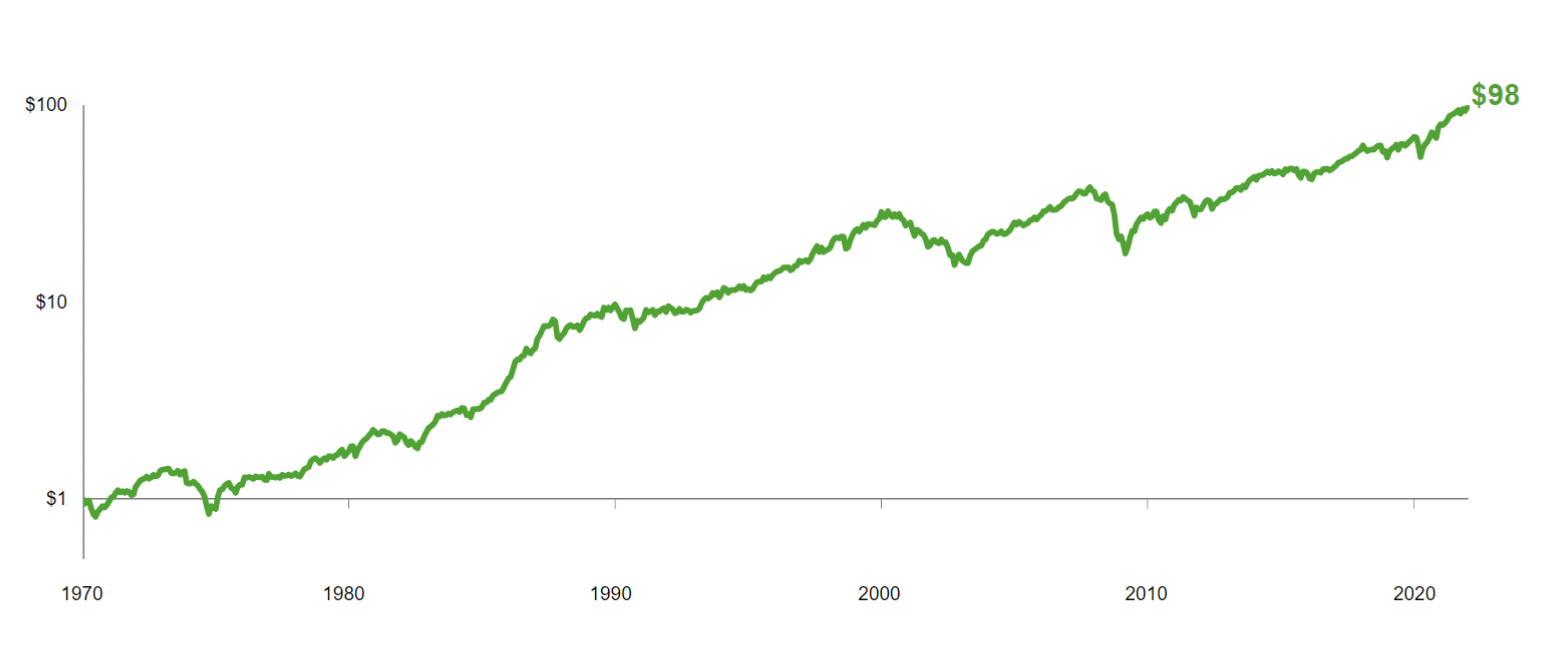

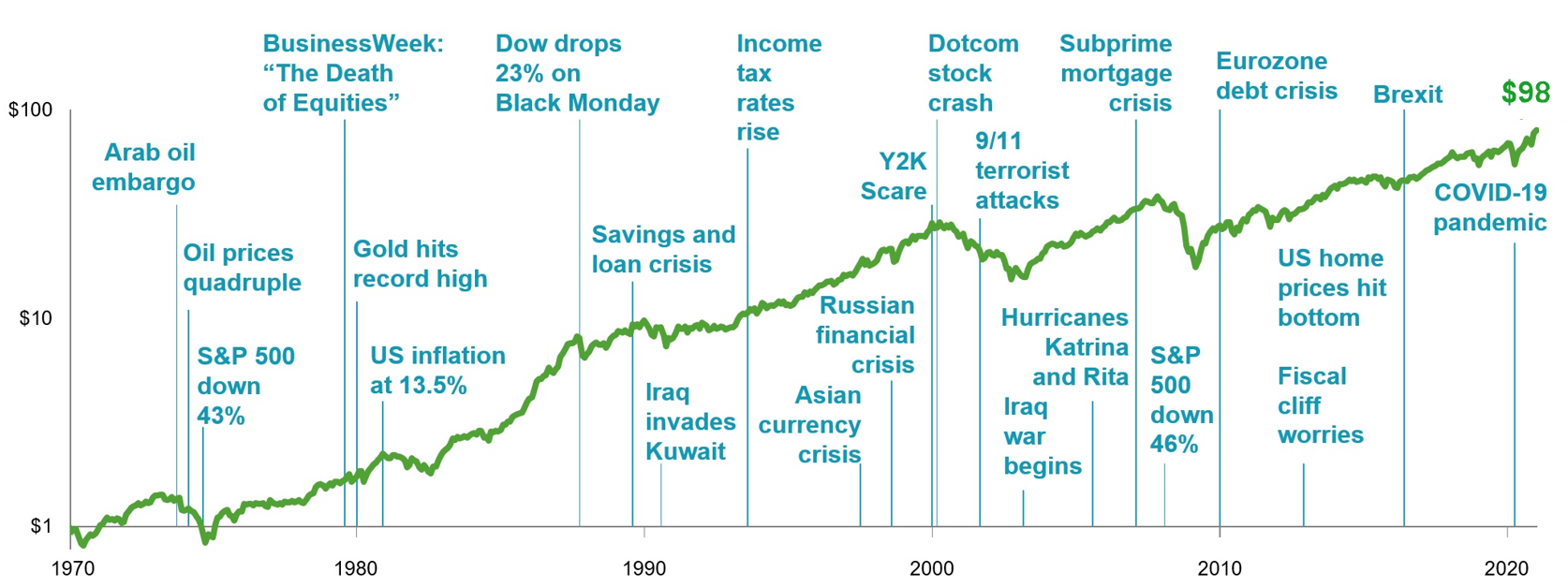

Historically, how have markets reacted to “bad news,” as we’ve seen over the past couple of years? Let’s take a look at the chart below.

You can see that the chart here is a green line that rises up and to the right along the time frame provided, which is 1970 to today. If you invested a single dollar in 1970, you’d have almost $100 today. Over this period, your initial investment would have grown 100 times.

Note, this return doesn’t even include dividends from the portfolio that could have been (1) reinvested to increase that investment even further or (2) cashed out to provide ongoing income. So, for the sake of this argument, we can ignore that, but keep in mind that there was more earning potential beyond this green line.

As we begin to layer some of the significant worldwide events that we’ve been through since 1970 over this chart, we can see how the market fared.

As you can see, the green line trends up and to the right over time, but the road was not always a smooth one. There were temporary dips along the way. We’ve had embargos, wars, disease, political conflict—many things that we hear about affecting our economy today. Yet, the green line continued to rise up and to the right every time.

There Will Always Be Bad News, but Time is On Your Side

The takeaway is that there’s never really been a time when we’re not dealing with something. There are always some headwinds challenging the market. Even though we’ve been at a 10-yr low in the way people might feel about the economy’s prospects, we must realize that time is on our side. Looking back, we can infer that it pays to be a long-term investor and focus on the bigger picture plan.

There is always bad news out there. Sometimes the best thing you can do is turn off the TV, delete those financial news emails while they’re still unread, and focus on what you can control.

Remember, your health and well-being aren’t just shaped by what you eat or your daily activity level. Your health is also influenced by what you watch, read, and listen to each day. If the news is constantly causing you to second guess your financial plan, it might be time for a detox. After all, if bad financial news doesn’t affect the market over the long term, it shouldn’t affect your long-term plan.