After years of low-interest rates, the Fed will be raising rates to combat inflation. Naturally, investors are worried.

Is this going to be bad for the economy?

How will the markets react?

What will happen to my portfolio?

To watch my video on this topic, click on the image below:

Fed Rate Hikes Aren’t New.

Rate hikes aren’t new. The Fed has done this before. After all, the fund’s rate is a tool the Fed can use to help maintain a healthy economy. To combat double-digit inflation, the fed funds rate was raised as high as 20% in 1979 and 1980. Most recently, it was lowered to 0%-0.25% in March 2020 in response to the coronavirus outbreak. Now, we’re seeing the Fed begin to raise interest rates aggressively.

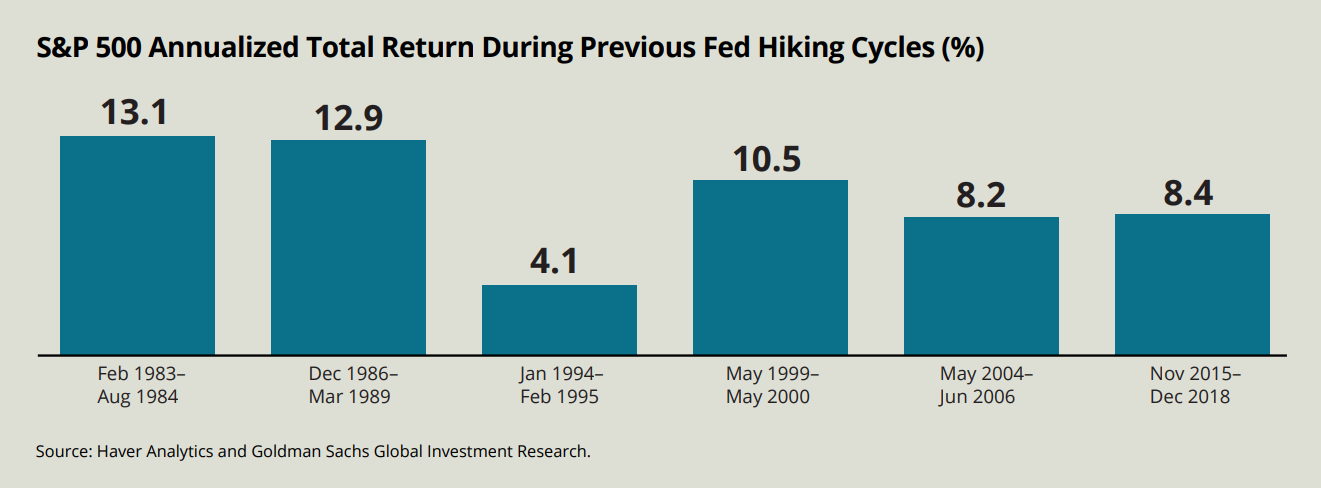

To get some perspective on what could happen, let’s look at how the market has reacted in the past.

The chart above goes back a couple of decades, looking at cycles of rising interest rates. Over that time, we can see we haven’t always gotten great returns, but it has been positive in varying degrees.

What does that mean?

It does NOT mean that the market is 100% going to fall, and we’ll nosedive into a recession. But it also indicates that returns might not be soaring sky-high, either. In other words, it doesn’t look a lot different than when the Fed isn’t raising interest rates. You win some; you lose some. Stay invested either way.

How Have Interest Rates Affected Other Asset Classes?

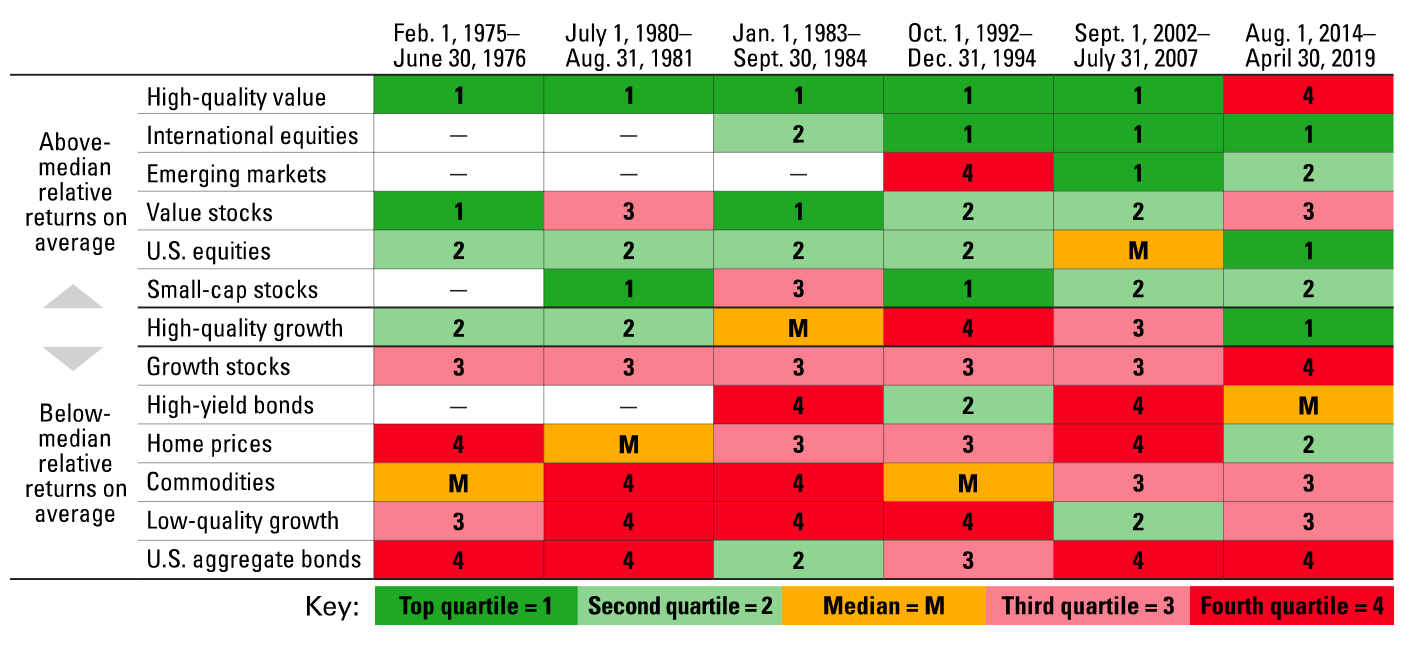

Now the chart we looked at above only shows the S&P 500. There are plenty of other asset classes out there. Let’s look at the chart below to see how other assets do during rising rates.

This chart is more complex than the first one, as you’ll see from a glance. But zoom out and notice the green and red spreads. The green boxes indicate when certain classes have performed well with rising interest rates, while the red indicates the opposite—classes that have not performed well in a rising rate environment.

You’ll notice the top half of the chart is mostly green, and the bottom half of the chart is mostly red. The classes above the line are typically the better performers, while those below are not. Let’s focus on the asset classes that have not done well, including:

- Growth stocks

- High-yield bonds

- Home prices

- Commodities

- Low-quality growth

- US aggregate bonds

The bonds are no surprise. When interest rates rise, bond prices go down. That’s pretty clear. But some of the other asset classes might be more surprising—things like commodities and homes.

Bringing It Full Circle—from Rising Rates to Rising Inflation and Back Again

Historically, home prices, real estate, and growth stocks haven’t fared well in rising rate cycles. But when you think about it, this makes sense. Home prices and commodity prices increase due to the same inflation that the Fed is raising interest rates to combat.

It’s important not to get wrapped up in the things that have been doing well and instead look historically at what gives you the greatest chance of success given all the factors at play—of which interest rates are just a single factor.

Remember to keep an eye on what you own, understand why you own it, and never lose sight of the role those assets hold in the big picture view of your portfolio. The rest is just noise and shouldn’t affect your investment decisions.