2022 has been a rough year, with large sell-offs in the stock market taking investors on a bumpy ride.

On May 5th, a day after the Federal Reserve raised its benchmark interest rate by half a percentage point, investors sold out of the part of the market that’s typically seen as a growth driver—technology. Amazon dropped almost 8%, and Meta suffered a roughly 7% loss. Apple fell nearly 6%, and Microsoft slid 4%. Overall, the Nasdaq plummeted 5%. And over the past six months, it has sunk 26%.

How Are “Smart Money” Investors Faring?

Smart money is a term used to refer to the capital controlled by institutional investors, large investment firms, market mavericks, central funds, and other prominent financial professionals. The term “smart money” also refers to the influences that move the financial markets, often led by the actions of the central banks.

Now, when we look at how the market is doing or how it will react to a particular event, we look to smart money to see what’s happening. Smart money can serve as a litmus test for many investors to see how things will play out.

It is only natural to wonder: Do they have an inside track? Am I missing out on something? What should I be doing? I feel like there is something I don’t know.

But the truth is, not all smart money is smart. Take Tiger Global as a prime example. Here is a large fund that has not done very well given the recent selloff. They’re brilliant people with great resources, but they aren’t celebrating right now. This is just how it sometimes plays out on the other end.

Tiger Global illustrates that there isn’t a secret that you don’t know.

Spectacular Gains Today, Huge Declines Tomorrow

Have you ever heard of a disruptor stock? They’re stocks in companies that people see as turning the conventional way of doing business upside down. Many are household names like Peloton, Zillow, Netflix, Tesla, Apple, and Amazon. People are naturally fascinated by these companies because of the potential they show to deliver outsized returns in a short time. In other words, they hold the promise of helping you “get rich quick.”

Some of the difficulties in investing in these companies are that their prices can fluctuate dramatically in a short period, and there is significant risk in trying to profitably time your purchase and sale. The odds of getting it right are slim, and the losses from getting it wrong can be harmful.

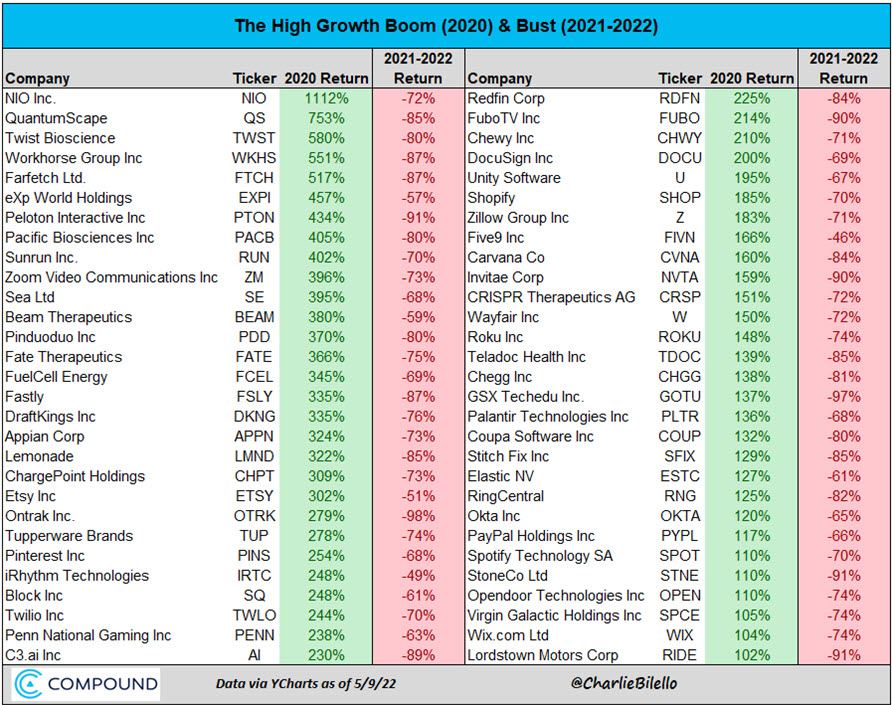

The stocks skyrocketed when these companies hit the scene, as you’ll see in the chart below. Irrespective of the earnings they have or the cash flow they have, the prices keep going up. Of course, this feels very attractive. You may have been tempted to jump on the bandwagon.

But, when you see these spectacular gains, they are often followed by significant declines, as you can see in the chart above. Since their heydays, many of these companies have gone down, and how far down ranges from mild to dramatic.

It All Comes Out in The Wash

When people start talking about “smart money,” saying they are “killing it” and “it’s different this time,” or a fund or an investment manager seems like they know things that other people don’t, remember this: it all comes out in the wash. Nothing is immune to market movement or volatility, which is what we’re seeing in the market today.

There is no secret. There isn’t something you’re missing out on. Smart money gains and losses might not correlate with the ones you’ll see in your portfolio—particularly if you hold a more conservative allocation—but they shouldn’t. Your portfolio should reflect what is best for your time horizon, risk level, and financial needs now and in retirement.

As always, make sure you understand (1) what you own and (2) why you own it and stick to making the money moves that are right for you. The minute you let outside noise influence your decision-making is when things can go awry.