Warren Buffet. The man. The “Oracle of Omaha.” The legend. Despite being immensely wealthy, he is known for his long-term investment philosophies and frugality.

To watch my video on this topic, click on the image below:

Buffet started investing at age 11 and remains at the top of his game at age 91. He is the chairman and CEO of Berkshire Hathaway and one of the most successful investors in the world. He is the sixth-wealthiest person alive, with a net worth of over $116 billion as of May 2022.

Sounds pretty legendary to me. If only we could be as lucky, you might be thinking. Well, you can. Because the secret to his success isn’t luck. In fact, it’s not a secret at all. Amazon founder Jeff Bezos asked Warren Buffett, “Your investment thesis is so simple. Why don’t more people copy you?” Buffet replied, “Because nobody wants to get rich slow.”

The Power of Compounding

When you think about how Warren Buffet got so wealthy, you might just think, “Well, he’s an incredible investor.” Yes, he is. But there’s one thing, and that is just as important, if not more important, than his investment skills. I am talking about his time frame.

Warren Buffett has been investing for decades. He is over 91 years old. Throughout his lifetime, he has been harnessing the power of compound interest—a phenomenon Einstein called the eighth wonder of the world. This means his wealth has been consistently building on itself over time. It sounds incredibly dull, but the end game makes up for it.

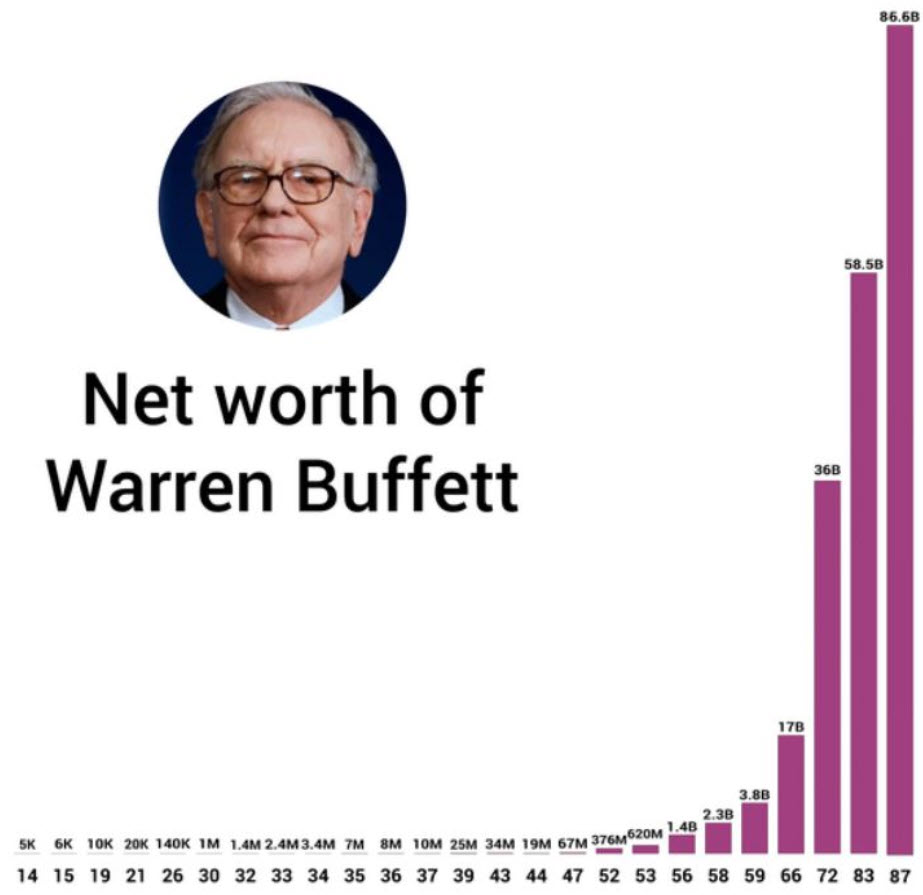

The chart below shows how Warren Buffet’s wealth grew over time. You’ll notice that it’s relatively flat until it shoots up quickly at the end. As you can see, in his 30s, he was doing OK, worth around $10 million. But Warren Buffett did not become a billionaire until he was in his late 50s.

This does not mean that his investments did much better later than he did in his younger years. It also doesn’t mean the market was yielding higher returns. His wealth grew and grew upon itself until it saw exponential increases. This is the power of compound interest. This is the power of investing over time.

The most complicated work in investing is done upfront. But the longer your money remains invested, the harder it goes to work for you—earning more with less effort. In other words, the earlier you start saving, the less you have to save (or contribute) to reach your goal. Time and compounding do the work for you. Hence, Einstein’s awe of this phenomenon.

It’s Time IN the Market, Not Timing the Market That Worked for Warren Buffett

Most people find the reality of Warren’s success hard to believe. Is it that simple? Buy and hold, control your spending, and continue to let your investments compound through buying companies? The miracle here isn’t as much in his being the greatest investor that ever lived, but perhaps in his being the most patient and consistent.

It turns out the best kept investing secret isn’t a secret at all. It’s just that most people can’t “wait for the right pitch” and miss out on these potential compounding gains. You see, the investing experience is an emotional one. From extreme highs when the market is doing well to extreme lows when numbers dip, few things can make you more emotional than your money.

The problem is that your emotions can lead you to make the exact wrong decisions at the wrong time, putting your long-term investment plan at risk.

Even though “the secret is out,” buying, holding, and keeping an eye on the long-term can be easier said than done. This is why it’s imperative to lean on the guidance of your financial advisor when markets get rough and remember it pays to stay invested.