Do you ever see or read market updates in the financial news that don’t align with what you see in your portfolio? The news says one thing, but your statements say another. If this has happened to you, then chances are you don’t quite understand what you own or why it’s in your portfolio, which can cause a lot of unnecessary financial stress.

To watch my video on this topic, click on the image below:

I often get calls from my friends and family with this broad yet serious question: “How are the markets doing?” And my typical response is this: “Which market?”

Now, I know this isn’t the answer the questioner is looking for. It isn’t an answer and can make me come across as…well…annoying. But asking how the market is doing is a trick question.

There is a reason they say, “There is always a bull market somewhere,” and that is because there is more than one market to choose from, and not all perform well or poorly at the same time.

So, answering the original question with my follow-up question is the only thing that makes logical sense. It simply depends on which market you want to know about.

Different Markets Perform Differently at Different Times

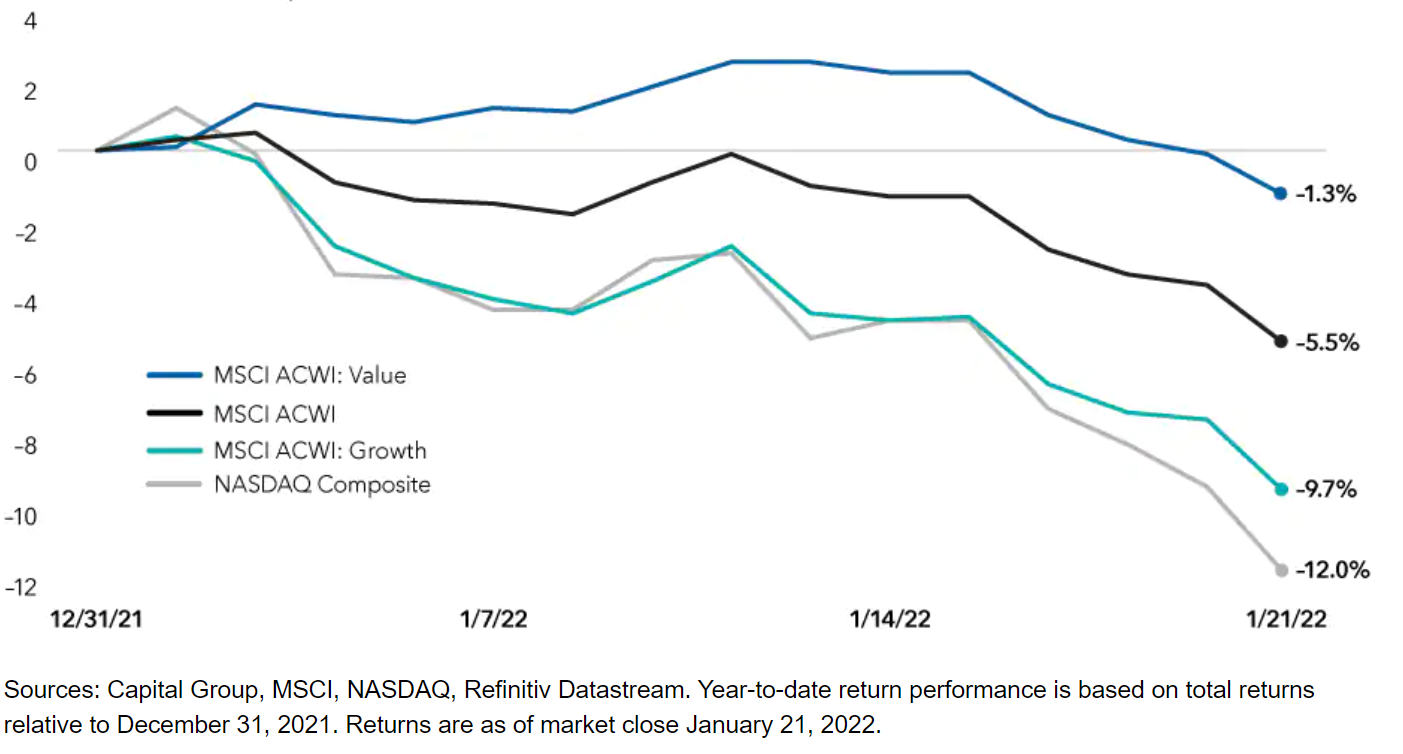

Think I overused the word “different” here? Good! Because it illustrates my point. There are too many markets and too many factors affecting those markets at any given time to be able to give one definitive answer to the question above. Let’s dissect this further using the chart below.

This chart reflects a summary of 2022 markets through the third week of January. This chart shows us how different the returns can be in different markets over the same time period.

If you look at the MSCI Global Value Index (value stocks all over the world), it’s down about 1.3%. And then, if you look at the broad global market—which is a mix of value and a mix of growth—it’s down around 5%. Now, if you look at the global growth, it’s down around 9%. And if you look at the NASDAQ, which is US technology growth, it’s down 12%.

There is a BIG difference between -1% and -12%. This explains why what you read or see in financial news isn’t always reflected in your statement—you might not be holding much of what is being discussed.

Know What You Own and Why You Own It

The moral of the story is something I talk about a lot. You need to understand what you own and why you own it. Do I own value? Do I own growth? Why do I own these, and how can I expect them to perform in this environment?

If you are unsure how your portfolio is positioned– or how this may impact your retirement–let’s talk.