Investing can be overwhelming, but with the guidance of three fundamental pillars, you can move forward with confidence. These foundational pillars are Faith in the Future, Patience in the Presence, and Discipline in Your Decisions. Let’s dig deeper into each one.

1. Faith in the Future

A key cornerstone of successful investing is pragmatic optimism about the future. This doesn’t mean believing the world is or will be perfect, but rather recognizing the resilience and growth potential of global markets.

Why It’s Crucial:

Being a long-term investor requires a certain degree of confidence in the future. If you’re constantly in dread of a global market collapse, it becomes challenging to invest with any long-term perspective. Truth be told, if such a catastrophic meltdown were to happen, no investment strategy could shield you entirely.

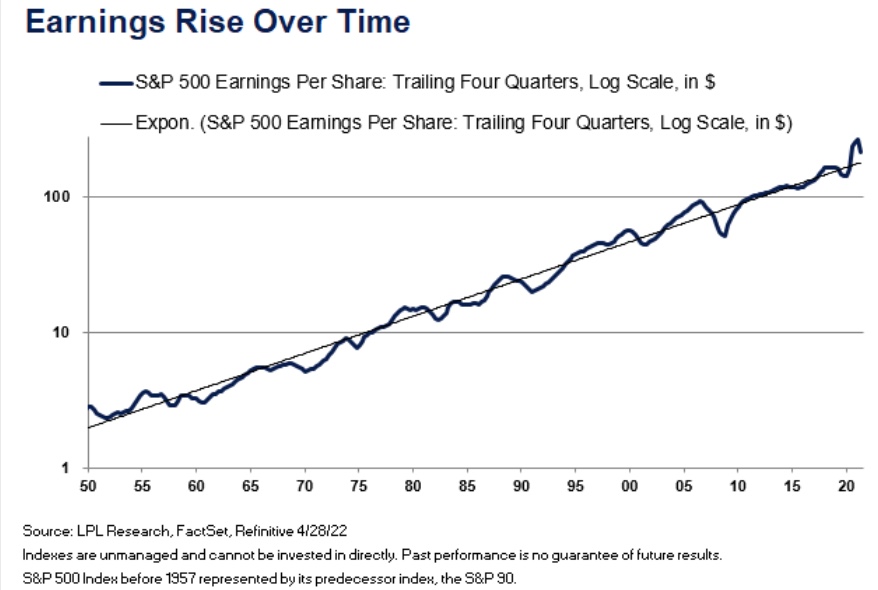

The Power of Long-Term Earnings:

While the world has faced countless challenges over the decades, one consistent trend has been the growth of companies’ earnings (chart below). For over a century, the earnings of companies have marched upward. By placing faith in this long-term trajectory and understanding that companies strive to grow and create value, investors can find a foundation for their optimism.

2. Patience In The Presence

In the fast-paced world of stocks, having patience is key. Staying grounded in long-term thinking without getting swayed by short-term disturbances is the second pillar.

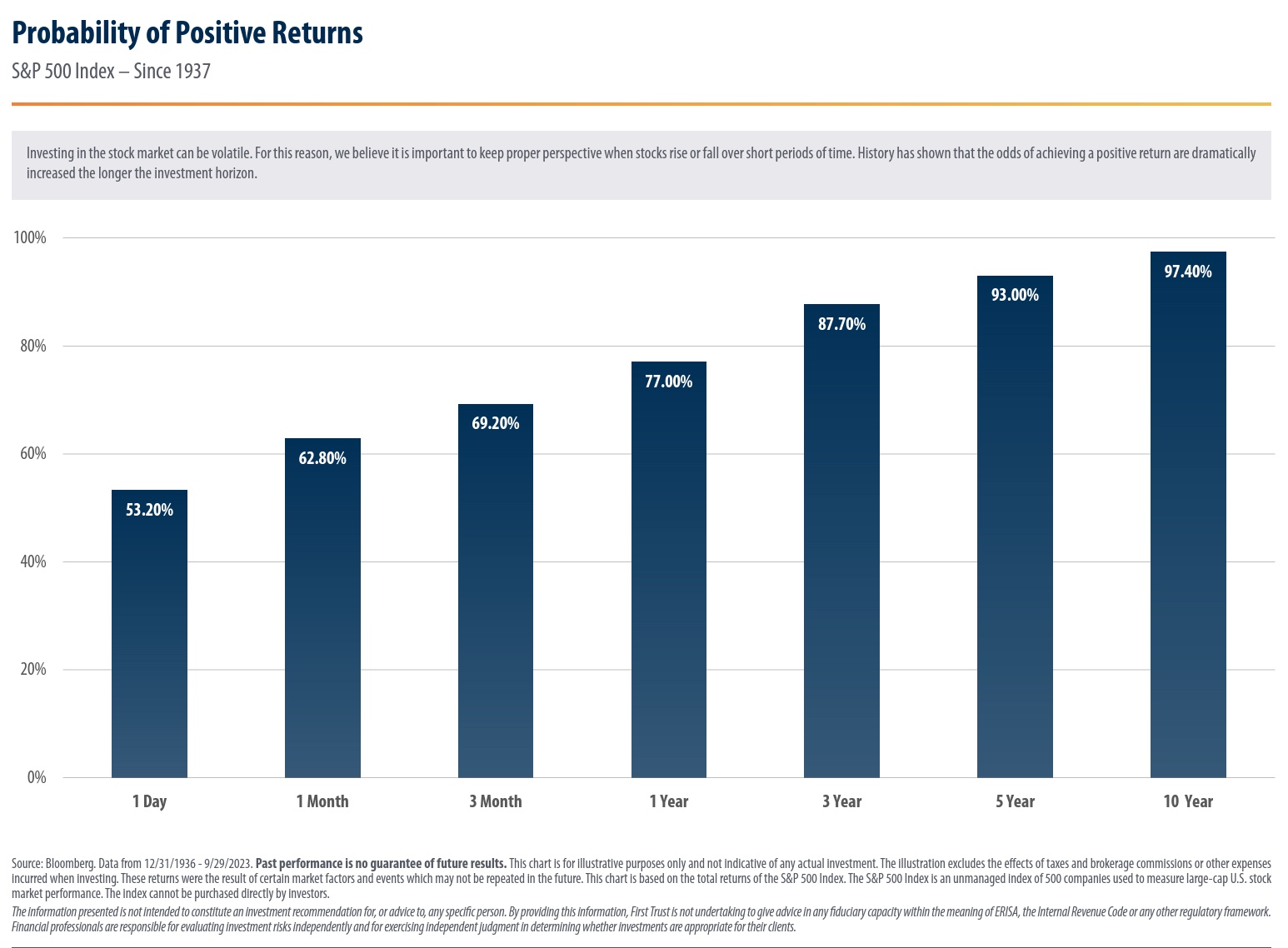

Short-Term vs. Long-Term:

In the short term, the market is largely unknowable. Its immediate movements, often influenced by transient events or sentiments, are unpredictable, and nobody can accurately forecast what will happen tomorrow. However, in the long term, the market’s trajectory is inevitable. Given enough time, markets go up. By internalizing this, a patient investor learns to look beyond short-lived fluctuations. The chart below shows your increasing likelihood of seeing positive returns over time.

3. Discipline in Your Decisions

The final pillar underscores the significance of making thoughtful, deliberate choices, especially when the market is uncertain (which is always).

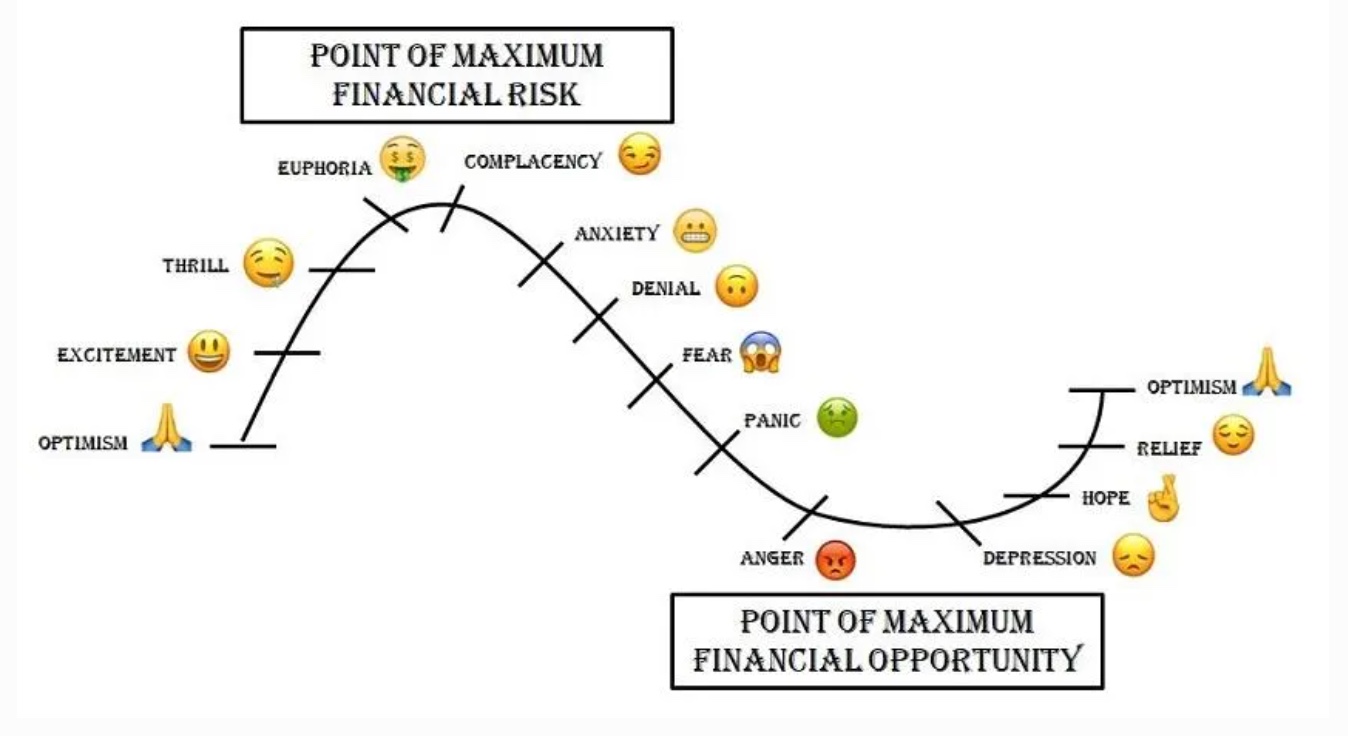

Emotions and Choices:

Feeling joy when stocks ascend, and disappointment when they fall is natural. However, with discipline, an astute investor perceives market downturns as ripe opportunities. Buying when prices are low can set the stage for notable gains during market recoveries.

Staying Steady:

Achieving success in long-term investing often requires making choices that might diverge from popular sentiment. Whether practicing restraint in a frenzied market or spotting opportunities amidst widespread skepticism, the objective of investing is to purchase future cash flows at the best possible price. Many times, this is when most are too scared to make the decision.

In Summary:

Throughout your investment journey, always let these three pillars guide you: Faith in the Future, Patience in the Presence, and Discipline in Your Decisions. Grounding yourself in these principles empowers you to ignore the noise and focus on what matters most.