Asset allocation is one of the most important issues long-term investors should understand. Unfortunately, this topic doesn’t get much attention. According to recent research from GMO, a prominent investment firm, the divergence in expected returns across asset classes has created one of the biggest relative asset allocation opportunities investors have seen in over three decades. Let’s dive into what this means and why it’s so crucial for long-term investors to pay attention.

WATCH: The Biggest Relative Asset Allocation Opportunity in 35 Years

{% video_player “embed_player” overrideable=False, type=’hsvideo2′, hide_playlist=True, viral_sharing=False, embed_button=False, autoplay=False, hidden_controls=False, loop=False, muted=False, full_width=False, width=’3840′, height=’2160′, player_id=’166225436207′, style=” %}

Asset allocation refers to how you divide your investments across different asset classes like stocks, bonds, real estate and others. Within stocks, you can further allocate between U.S. stocks, international stocks, value stocks, growth stocks and more. Getting your asset allocation right is paramount for achieving your long-term investment goals.

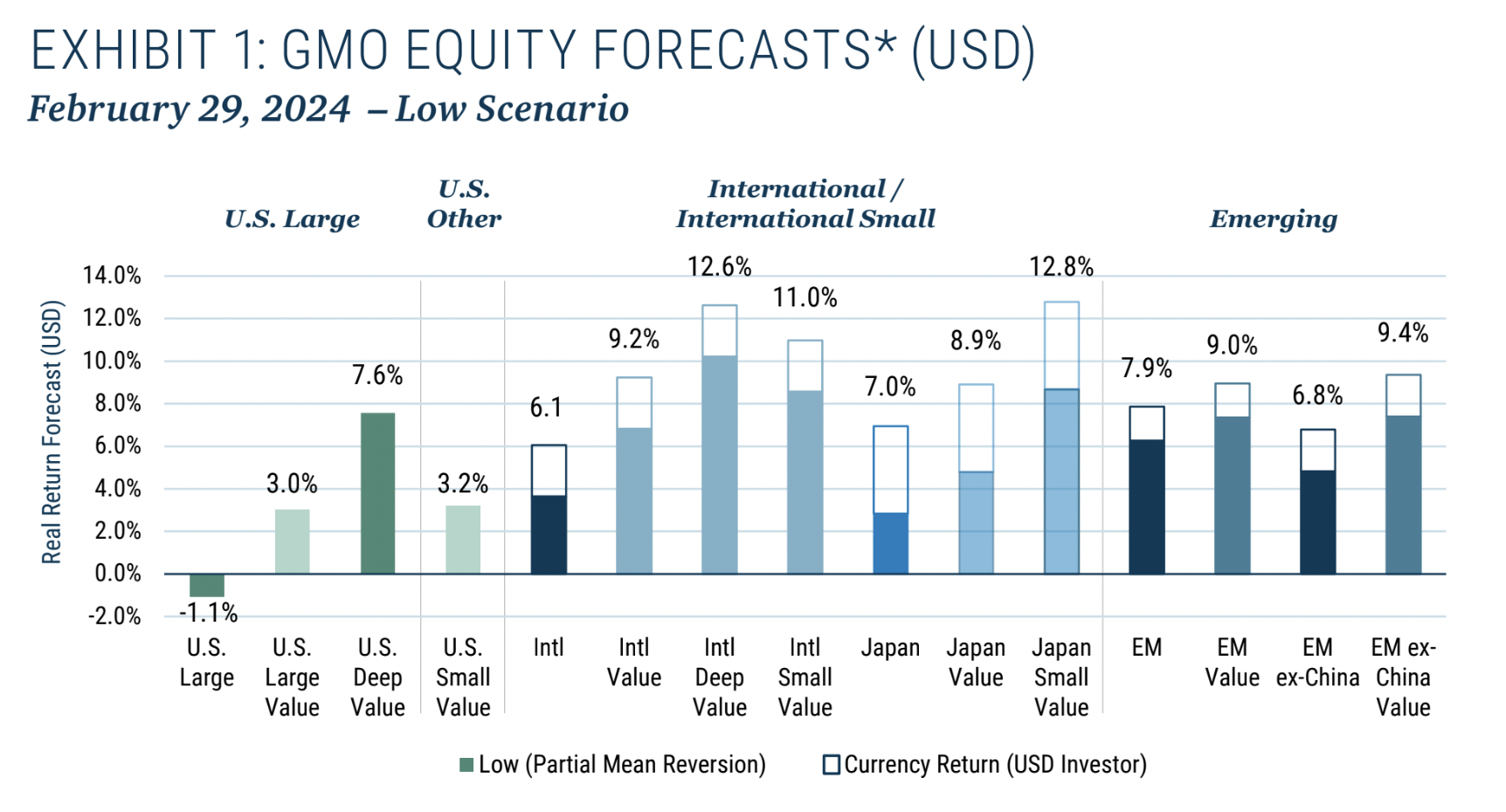

The research firm analyzed forecasted 7-year expected real returns (after inflation) for various equity asset classes. Their findings, illustrated in a revealing chart, unveil a striking divergence in potential returns that highlights the importance of strategic asset allocation currently.

On the left side of the chart, we see that U.S. large-cap stocks like those in the S&P 500 are expected to deliver a negative annualized return of -1% over the next 7 years. This suggests the firm views current valuations for U.S. large-caps as quite expensive based on their models.

However, if we look at cheaper U.S. value stocks, particularly in the “Deep Value” category of really inexpensive names, the forecast improves to a healthy +7% annual return. This highlights the return disparities within the U.S. market itself based on valuations.

Turning to international markets in the middle of the chart, the forecasted returns look far more appealing at +6% for developed international stocks. Emerging markets on the far right are projected for stellar +12% annual returns over the next 7 years based on the estimates.

The white sections in the bars represent expected currency impacts for the international/EM holdings. This reminds us that for these asset classes, returns can vary not just based on stock price performance but currency fluctuations as well.

So what does this forecast chart tell us about asset allocation? When you have such a divide, with some asset classes priced for poor returns and others priced for extremely attractive returns, your portfolio allocation mix becomes critical.

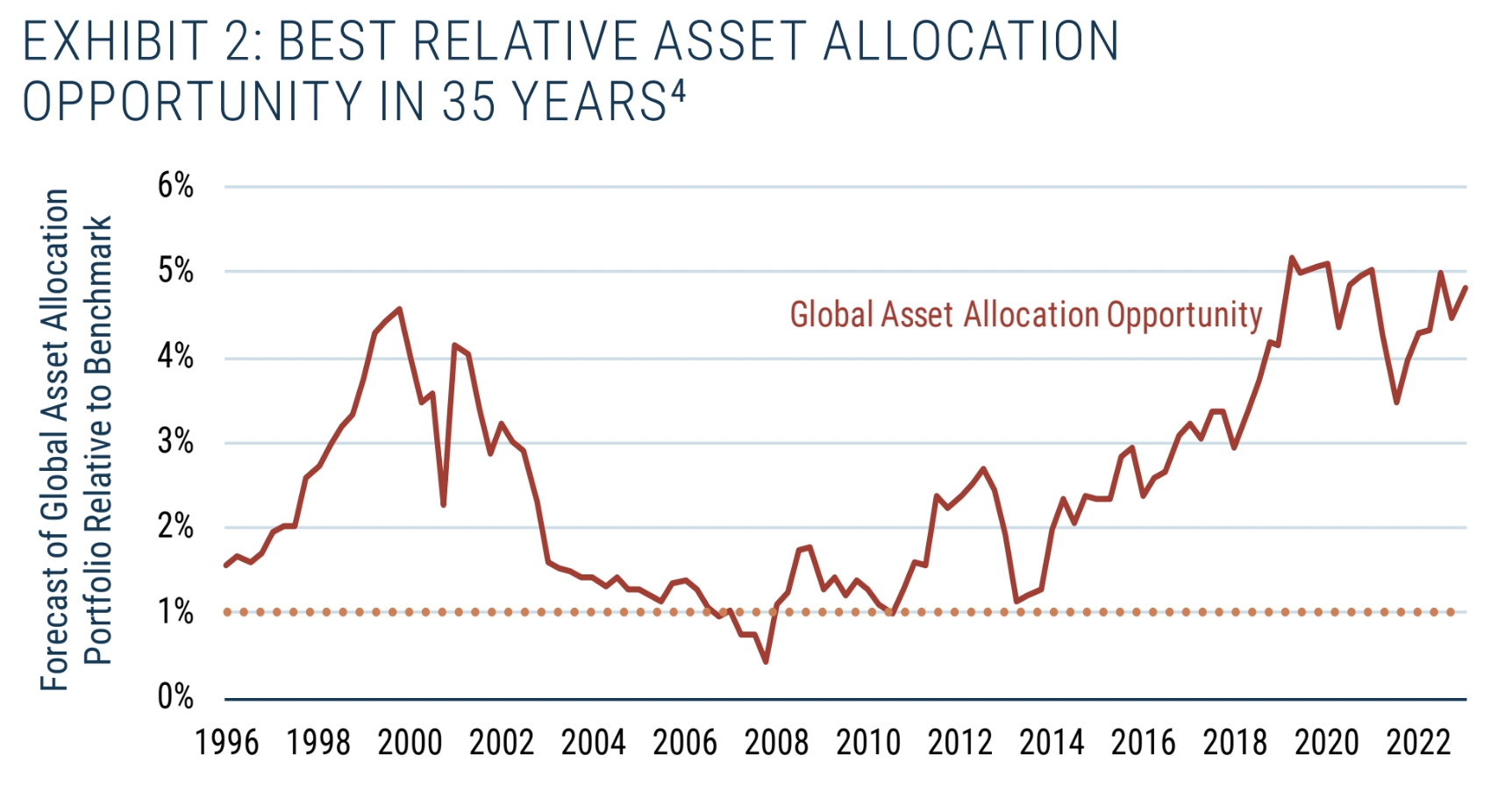

The research firm hammers this point home with another chart showing the importance of asset allocation over time. It plots an indicator that essentially measures the return divergence across asset classes. The higher the indicator, the bigger the potential return difference based on your allocation decisions.

According to this second chart, we are currently at one of the highest readings for this asset allocation importance indicator in over 35 years. The only other period that comes close was around 2000 – the peak of the dotcom bubble. At that time, being underweight expensive large-cap growth stocks and overweight value names was key.

Today, we face a similar divergence, but now it’s U.S. large-caps like the S&P 500 that look like the relatively expensive asset class to potentially underweight based on expected returns. In contrast, international/EM and value stocks offer much more attractive potential returns from current valuation levels according to the forecasts.

The reason this asset allocation decision is so important right now, as the research emphasizes, is that most investors remain concentrated in the “expensive” S&P 500 through their 401(k)s, IRAs, and other wealth. With these large-cap U.S. names priced to potentially underperform going forward, a portfolio merely mimicking the S&P 500 could struggle to achieve desired returns.

However, by diversifying reasonably away from overvalued U.S. large-caps and into relatively cheaper international and value stocks, investors have an opportunity to drastically improve their total portfolio returns over the next several years based on the forecasted return divergences.

Of course, these forecasts are not certainties. And they can certainly be wrong. But the research highlights a valuable framework for evaluating asset class opportunities through a valuation lens. It underscores why investors should periodically review their asset allocation mix with advisors who can provide objective analysis.

Adjusting portfolio exposures to align with current value opportunities across asset classes like highlighted in these forecasts could dramatically improve returns over an investor’s time horizon. For those with concentrated U.S. large-cap positions, the potential opportunity cost of ignoring this divergence could be massive if it plays out as projected.

In summary, the research reveals one of the largest divergences in asset class valuations and return forecasts that we’ve witnessed in over 35 years. This highlights why prudent asset allocation across relatively cheap and expensive investments has rarely been more crucial. By working with an advisor to re-evaluate and rebalance your portfolio mix, you may be able to harness this extreme relative asset allocation opportunity to significantly enhance your long-term investment returns in the years ahead.