Investment returns are useful statistics we ought to pay close attention to when (a) we evaluate the performance of that company within our portfolio over a given period and (b) we are considering buying in or selling out of a particular investment.

To watch my video on this topic, click on the image below:

However, the flip side of the coin is that we need to understand that investment returns are not the same as investor returns. Investment returns are often much higher than investor returns. Here’s why.

The Media Has Been Influencing Buy-In Since the Beginning of Time

Have you ever heard the phrase “to the moon” concerning investments?

“To the moon” is a phrase that has been popularized over the past couple of years, specifically concerning crypto and meme stocks. This exclamation is often accompanied by the rocket ship emoji and is used when investors think the price of a stock or cryptocurrency will see a considerable increase. On that same note, “mooning” refers to a stock or investment thought to be peaking.

So what happens when a financial influencer or celebrity like Elon Musk tweets about an investment that’s going “to the moon”? People buy in at an alarming rate.

This may seem like a new phenomenon, but this has been happening in the stock market since its inception. But instead of celebrities and Tweets pushing interest in a stock, it’s been the media.

Problem #1: Investors Get in When the Stock After An Investment Has Gone Up

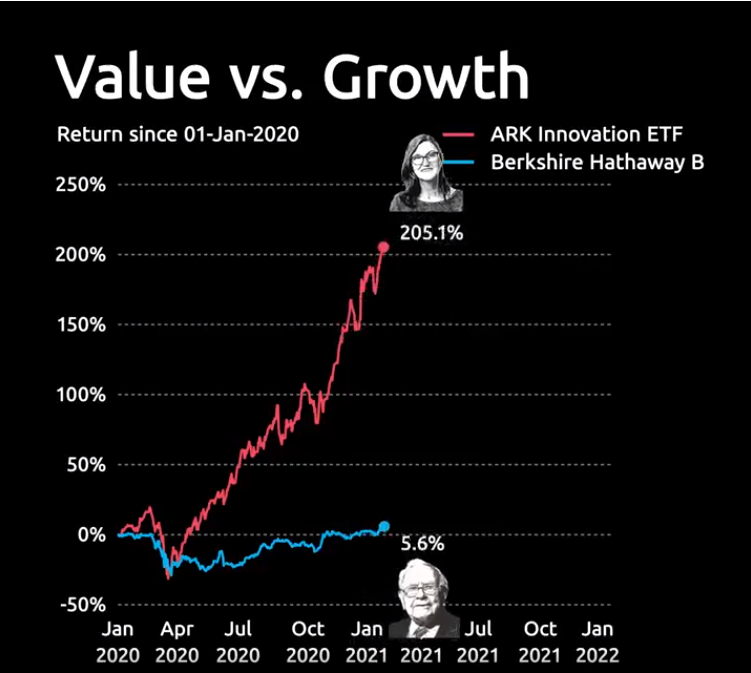

Let’s take a look at this in action. The chart below monitors the funds of two very different but very famous investment managers. The blue line at the bottom represents Warren Buffet’s returns on his fund, and the red line at the top that looks like it goes almost straight up is Cathie Woods fund, Ark Innovation ETF. While Buffet’s fund was up around 5%, Wood’s fund was up about 200%.

Not surprisingly, at this point, financial squawkers in the media were all saying, “What’s up with Warren Buffet? Has he lost his edge? Is Ark Innovation ETF the future?”

You can only guess what happened as Wood’s fund continued to rise and the media continued to sensationalize its success. People bought in!

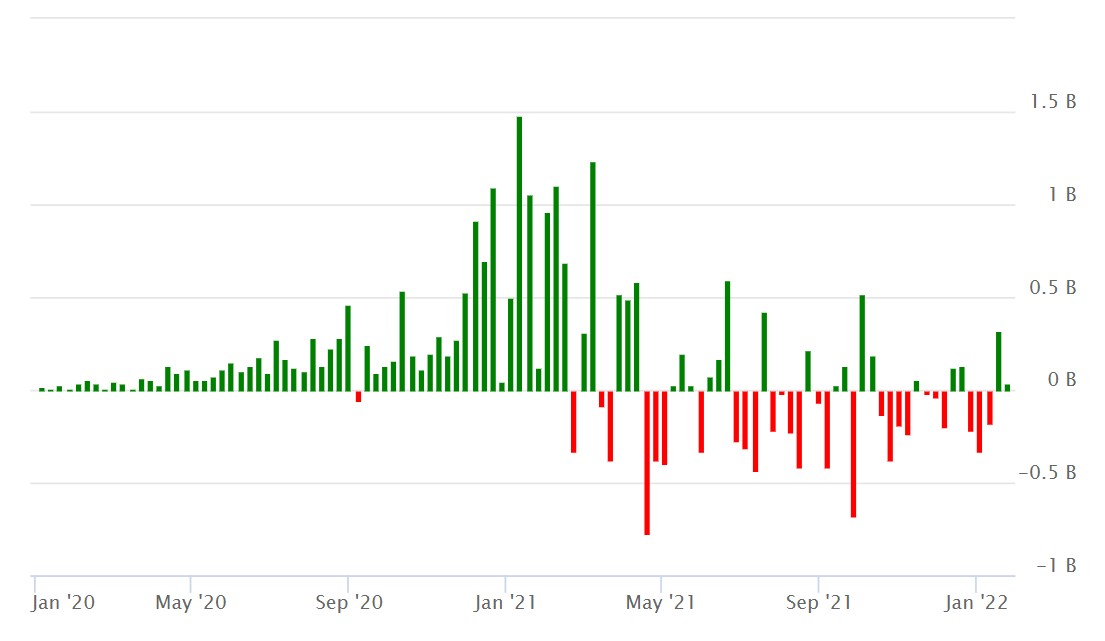

This fund flow chart shows exactly when most investors purchased the fund.

The green bars represent the dollars going into the fund and when they did so over these five years. As you can see illustrated by the tallest two green bars, the most buy-ins occurred in December and January of 2021, AFTER the fund was showing a 200% return. But, this didn’t last long.

Investor Returns are Dependent on the Purchase Date

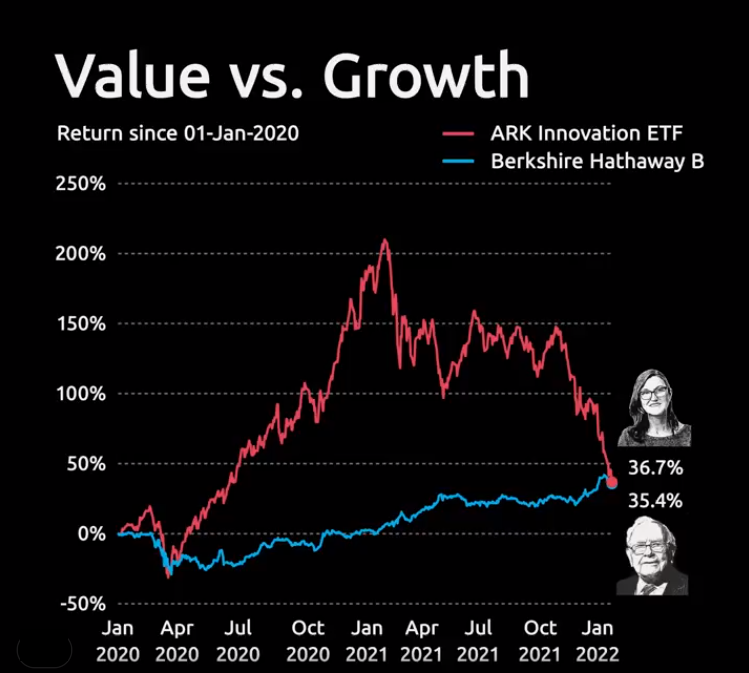

Guess what happened to the Ark fund once all these investors flooded in. It dropped dramatically.

The investment plummeted to end the year with about the same return that Buffet’s fund did—36%. Ok, 36% doesn’t sound so bad, even if it was a wild ride. But that’s not the whole story. Investor returns tell a very different story from overall investment returns because of how they are calculated, which has to do with when and how long the investment has been held.

Investment returns show the rate of gain or loss over a given period. Investor returns are the same, but they are calculated based on when the investor purchased the security. If you were one of the many investors that bought in at the height of the frenzy in December or January of 2021, your return is not 36%, but rather -40%. That’s because you bought in after the investment was already up.

To realize the same rate of return as the investment, you would have to own the investment over its entire lifespan. But hardly anyone owns stocks or funds before they are successful because no one has ever heard of them.

If you were an investor who did get in early, your return may be closer to the investment return. But if you got in later after the stock was already up —as often happens when a fund or company is in the media—there could be a significant gap in your return and that of the company.

Don’t Chase “To the Moon” Frenzies (Because It’s Likely They’ve Already “Mooned”)

Here’s a hint: when a whole lot of investors are doing one thing, many times it’s the wrong thing because they’re doing it after the sensationalized gains have already been made. If the good news is already out, it’s probably too late.

As always, know what you own and why you own it to make sure your portfolio is working to meet your long-term investment objectives.

If you need some guidance on your investment strategy or would like a second opinion on your retirement plan, don’t hesitate to reach out and schedule a free, no-obligation call with our founder, Kyle Walters. Atlas Wealth Advisors serves clients locally in the Dallas, TX area and virtually throughout the country.