For an increasing number of retirees, Social Security benefits are expected to play a more significant role in creating their lifetime income sufficiency. Understanding how your Social Security benefits are calculated is more critical than ever to ensure you choose the right payout option for maximizing your payout.

The “formula” used to calculate benefits can seem complex, but when you understand the critical components coupled with basic math, it’s not as daunting as it sounds. Of course, there are many nuances to the claiming process, so you’ll want to weigh the relative merits of each option before making a firm decision. The amount of your lifetime benefit depends on it.

Understanding the Social Security Benefits Formula

The Social Security Administration (SSA) utilizes a formula to determine your benefit amount, also referred to as your primary insurance amount (PIA). That is how much you are entitled to receive when you claim your benefits at your full retirement age (FRA). The full retirement age for anyone born in 1960 or later is 67.

When you turn 62, the SSA calculates your average indexed monthly earnings (AIME), which is your average earnings over your 35 highest-earning years, adjusted for inflation. That becomes one component of the formula for determining your PIA. However, the PIA may differ from your monthly benefit amount, depending on when you claim your benefits.

The Social Security Formula

For 2023, the Social Security formula is set as follows:

1. Take the first $1,115 of your AIME and multiply it by 90%.

2. Take the amount of your AIME between $1,115 and $6,721 and multiply it by 32%.

3. Take the amount of AIME over $6,721 and multiply it by 15%.

4. Total the results and round down to the next lowest, $0.10.

The AIME thresholds of $1,115 and $6,721 apply to the 2023 calendar year. The thresholds change each year.

Here is an example of how the formula works for an AIME of $3,000:

1. $1,115 x 90% = $1,003.50

2. $1,885 (the difference between $1,115 and $3,000) x 32% = $602.20

3. $0 x 15% = $0.00

4. Total: $1,605.70

The formula for determining your PIA is only applied for the year you turn 62, regardless of when you claim your benefits.

Calculating Your Social Security Benefits

You can always see how much your Social Security benefit will be by creating a my Social Security account on the SSA website. But this calculation overview will give you a better understanding of how it works.

The SSA bases your benefits on the amount you pay in Social Security taxes annually. The amount of your annual earnings that are taxed is capped. For 2022, the earnings cap is $147,000 and is increased to $160,200. Your yearly earnings are listed on your my Social Security account, but in years your earnings exceeded the cap; all you will see is the capped amount.

After adjusting your income for inflation, the SSA totals your income from your 35 highest-earning years (or the total number of years if you worked fewer years). They then divide the total by 420 (the number of months in 35 years) to arrive at your AIME. The number might be smaller than you expect if you worked fewer than 35 years because the equation will include some zero-income years.

Next, the SSA applies your AIME to the benefits formula outlined above to determine your PIA, which you will receive if you claim benefits at your FRA. If you choose to claim benefits at any other age, your PIA is adjusted up or down as necessary.

Adjusting Your PIA for Early or Delayed Benefits

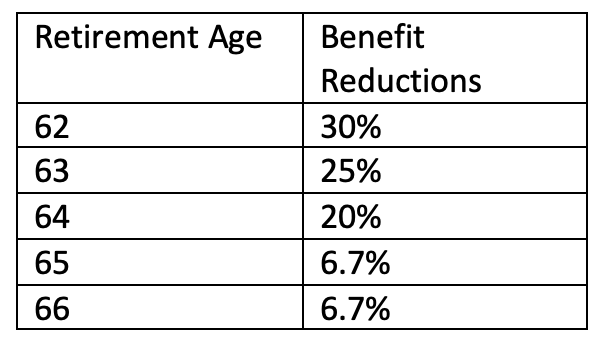

While you can start taking benefits at age 62, your monthly benefit would be permanently reduced by 30%. Each year you wait after age 62, the benefit reduction decreases until it reaches 100% at your FRA. The following chart assumes your FRA is 67.

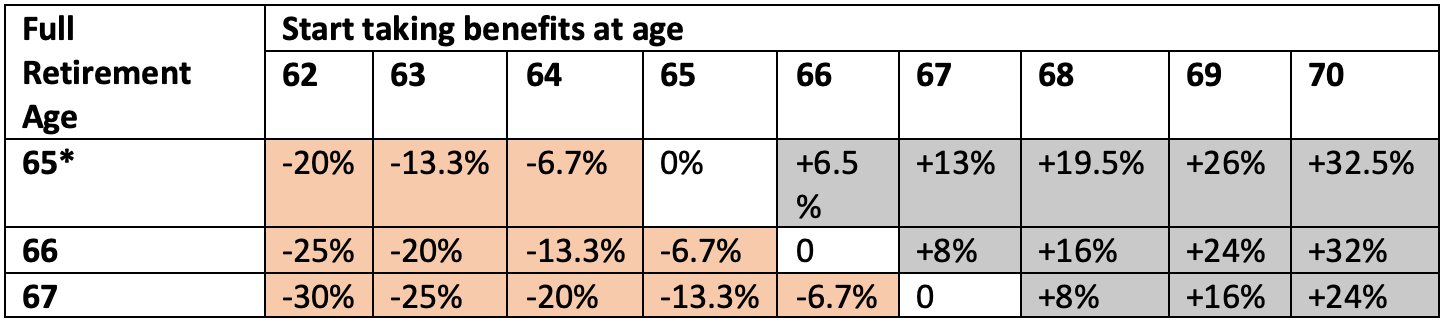

Conversely, you can delay benefits until up to age 70. In doing so, you will receive a Delayed Retirement Credit, increasing your benefit each year by 8%. That means you can lock in (up to) a 32% higher benefit for life depending on when you were born. This chart shows the spectrum of benefit changes based on your full retirement age and when you start taking benefits.

Using the Benefits Formula to Determine How and When to Claim Spousal Benefits

Another factor to consider when deciding at what age you want to begin receiving your benefit is the Spousal Benefit. The Spousal Benefit is available to the spouses of qualified workers. There are two scenarios to consider when reviewing the spousal benefit.

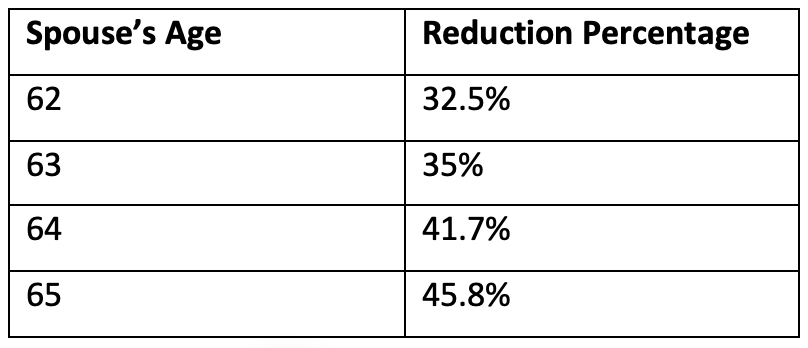

First, suppose your spouse needs to earn more credits to qualify on their own. In that case, they may apply for a spousal benefit based on your earnings once you choose to receive your benefit. Your spouse’s benefit would be equal to 50% of your PIA if your spouse is also at Full Retirement Age. If your spouse chooses to start receiving their spousal benefit before age 62, the following chart shows the estimated reduction in benefit.

Depending on your retirement income needs, there are various ways to use the spousal benefit to maximize your Social Security Retirement Benefit. Here’s a scenario you can entertain if you and your spouse are fully qualified.

Spouse #1 Full Retirement Age

- Takes retirement benefit

Spouse #2 Full Retirement Age

- Takes Spousal Benefit (50% of Spouse #1 Benefit) and takes Delayed Credit on their own benefit until age 70.

Why it’s Important to Understand How Your Benefits are Calculated

With an understanding of how your Social Security benefit is calculated, you are better positioned to make critical decisions about when to claim your benefits. For example, if you have zero-income years included in your calculation, you can choose to work extra years to remove them. Or depending on your spouse’s earnings and work history, you can make the right decision about choosing when and how to claim a spousal benefit.

The bottom line is that the more knowledge you have about determining your benefit, the better opportunity you have to maximize your lifetime benefit amount. Have questions? Schedule time with your financial advisor to help in calculating your benefit.