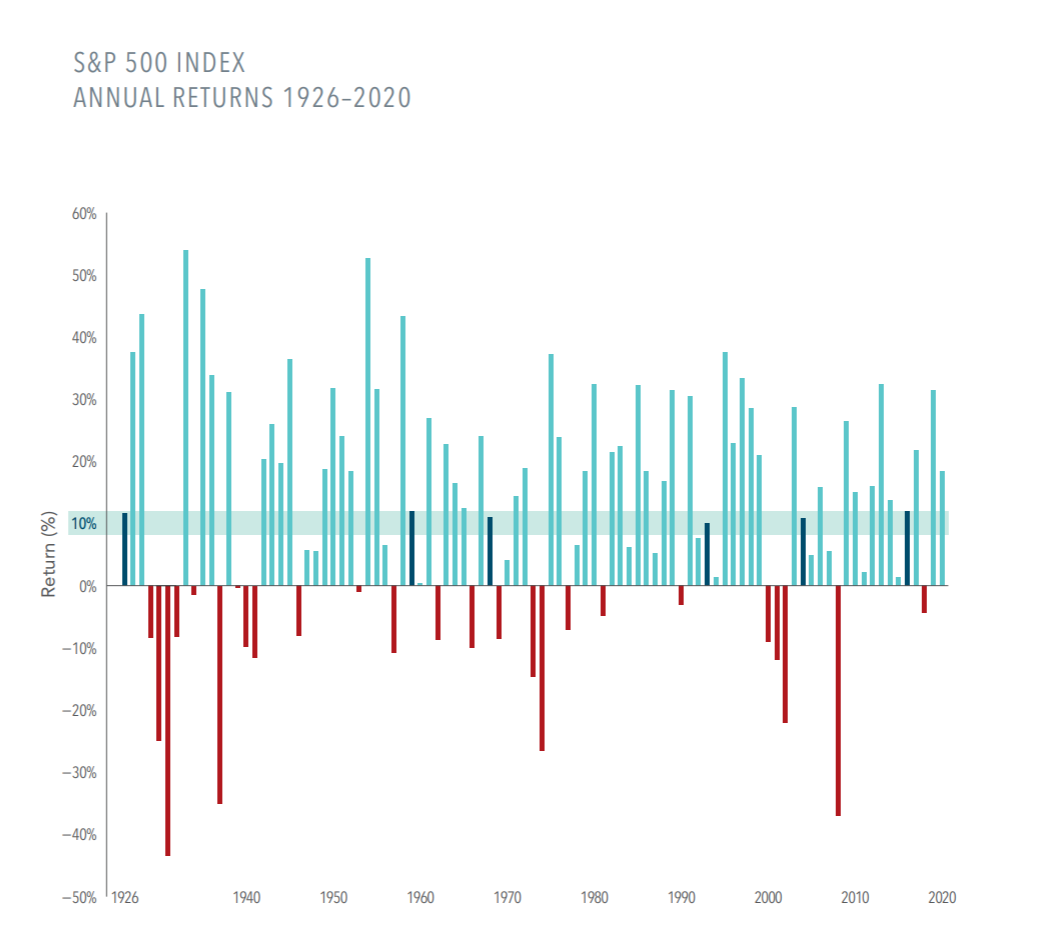

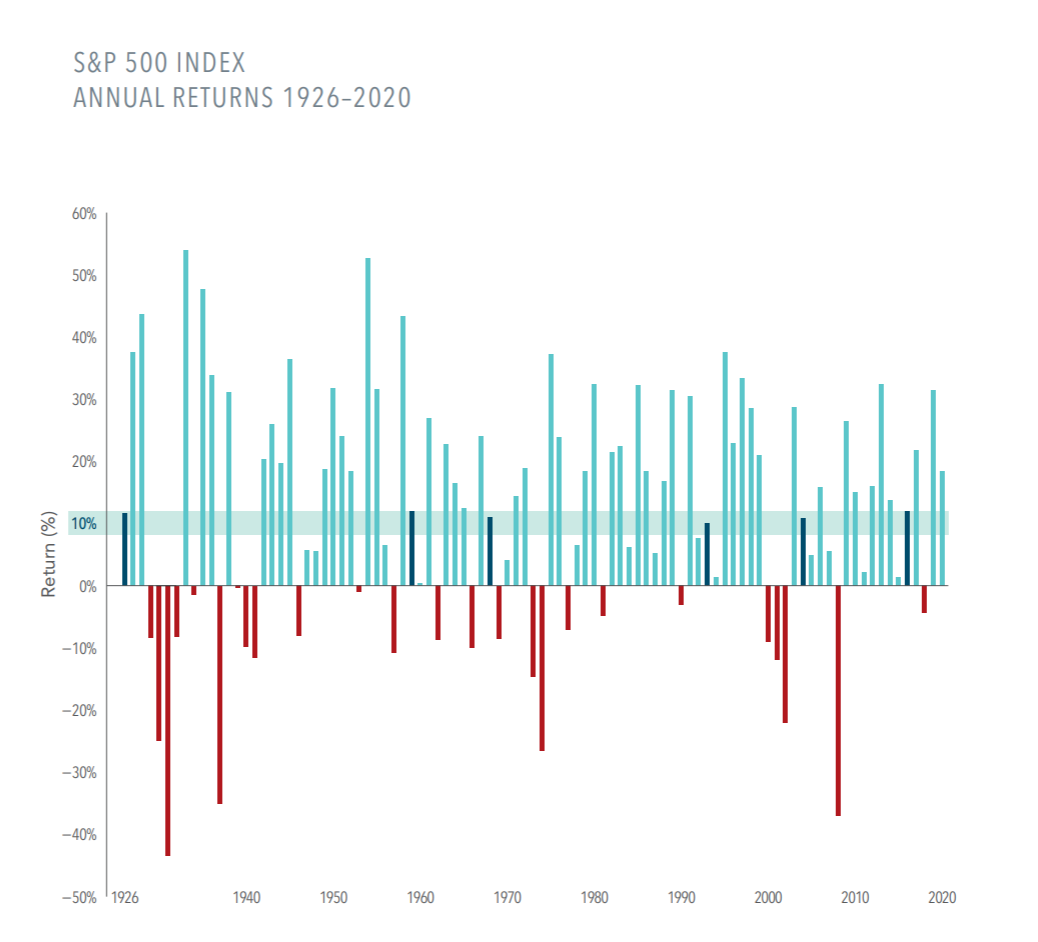

Since 1926, the US stock market has rewarded investors with an average annual return of about 10%. But it is important to remember that returns in any given year may be sky-high, extremely poor, or somewhere in between.

• Annual returns came within two percentage points of the market’s long-term average of 10% in just six of the past 95 years.

• Yearly returns have ranged as high as up 54% and as low as down 43%.

• Since 1926, annual returns have been positive 70 times and negative 25 times.

Understanding the range of potential outcomes can help you stick with a plan and ride out the inevitable ups and downs.

{{cta(‘f8900817-113c-4629-ba84-ae4904fab05a’,’justifycenter’)}}