4 min read

3 Takeaways from Warren Buffett’s Latest Letter to Shareholders

By: Atlas Wealth Advisors on Mar 15, 2017 8:07:04 AM

Warren Buffett’s most recent letter to Berkshire Hathaway shareholders is chock full of the kind of financial wisdom you might expect from a veteran investor who loves consuming information and synthesizing it into actionable ideas.

[caption id="attachment_7143" align="alignright" width="207"]

We’ve combed through the twenty-eight pages he wrote to extract a few nuggets of wisdom that we hope you’ll find helpful for your wealth journey. Here are, in our opinion, the three most important takeaways from his letter:

- Understanding intrinsic value,

- Understanding volatility, and

- Understanding fee structures.

1. Understanding Intrinsic Value

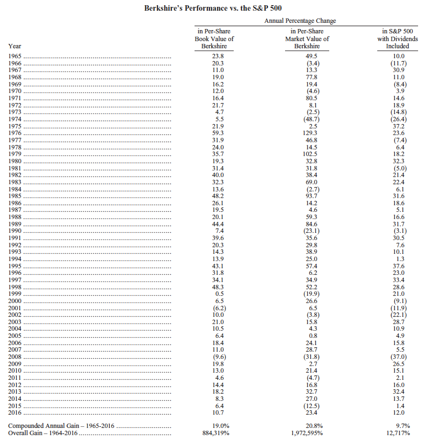

The letter opens with this table showing the book value to market value performance of Berkshire stock, as compared with the S&P 500, from the year 1965 through 2016.

Warren explains that Berkshire’s net worth was roughly equal to its intrinsic value in the earlier part of the table. But as time went on, the practice of acquiring entire businesses changed this, as some of those businesses proved to be “winners,” while others were found to be “losers.”

Gradually, this had the effect of widening the gap between Berkshire’s intrinsic value and its book value.

Over time, stock prices begin to reflect intrinsic value rather than book value, which explains how Berkshire’s fifty-two-year market-price gain outshined the book gain.

Warren drives home the importance of understanding intrinsic value by discussing share repurchases. He suggests the assessment process behind repurchases isn’t all that complicated.

For exiting shareholders, repurchasing is always good news, because it’s good to have another buyer in the market.

The continuing shareholder, on the other hand, should only repurchase if they can get them for lower than the intrinsic value. If this rule is followed across the board, remaining shares will immediately experience a gain in intrinsic value.

Our takeaway: At the end of the day, “value-enhancing” and “value-destroying” for the shareholder depend entirely on the purchase price, which depends largely on intrinsic value.

Warren offers the following suggestion:

“Before even discussing repurchases, a CEO and his or her Board should stand, join hands and in unison declare, ‘What is smart at one price is stupid at another.’”

2. Understanding Volatility

He continues his letter by pledging on behalf of Berkshire Vice Present, Charlie Munger, and himself, to make the earning power per share increase every year. He’s careful to explain that this doesn’t mean actual earning will increase every year.

Even Warren Buffett is subject to the ups and downs of the market. In spite of their efforts to be good stewards of the shareholders’ investment, a decline in the US economy, or industry specific events may occasionally reduce earnings.

Market volatility is unavoidable, but, as Warren points out, it’s important to be prepared for the bad and the good:

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons.”

Warren emphasizes the importance of being ready when there are serious gains to be made. He goes on to say that although America’s economy has been very good to several companies and investors, not all companies will make it. Lots of companies will fail, at least partially due to their inability to account for volatility.

Our takeaway: When the market starts looking scary and people start panicking, widespread fear is your friend, because it can serve up bargain purchases. Personal fear, on the other hand, is your enemy.

Warren suggests personal fear is neither useful or warranted, adding that most investors who just leave their investments in conservatively financed American businesses have nothing to fear.

3. Understanding Fee Structures

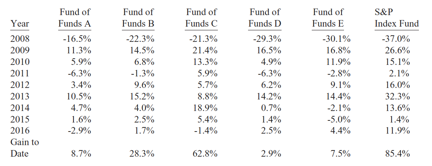

Next, Warren underscores the importance of understanding how fee structures work. When an active management advisor fails to outperform the market, the cost of those efforts gets built into the fees paid by you, the investor. Remember, it’s not impossible to outthink the market, it’s just highly unlikely and nearly impossible to do so consistently.

Warren used the above chart to give a quick update on his $500,000 bet that an unmanaged S&P-500 index fund could outperform any five hedge funds. As you probably know, only one fund manager took him up on the bet, and, as you can see, things aren’t looking too good for Warren’s opponent.

Warren used the above chart to give a quick update on his $500,000 bet that an unmanaged S&P-500 index fund could outperform any five hedge funds. As you probably know, only one fund manager took him up on the bet, and, as you can see, things aren’t looking too good for Warren’s opponent.

Warren gave a gracious take on the data:

“A number of smart people are involved in running hedge funds. But to a great extent their efforts are self-neutralizing, and their IQ will not overcome the costs they impose on investors.”

He went on to talk about how these funds are built for the benefit of the managers, not the investors. As a result, he encourages investors to stick with low-cost index funds.

Long ago, Warren’s brother-in-law, Homer, sold animals in the Omaha stockyards. Warren asked Homer how he convinced buyers from big companies to buy his particular animals since these buyers were experts who knew the value of every animal down to the penny.

Homer’s response holds true for how Wall Street is run to this day: “Warren, it’s not how you sell ‘em, it’s how you tell ‘em.”

Our takeaway: The cost of investing in actively managed funds largely isn’t worth the returns. Low-cost index funds are built to benefit the investor, not the fund manager.

So take it from Warren Buffett, intrinsic value, volatility, and fee structures make a big difference in your investments.

Want to talk about how these factors are affecting your portfolio?

[minti_button link="https://www.atlaswealthadvisors.com/contact-atlas/" size="small" target="_self" lightbox="false" color="color-1" icon=""]Contact Atlas Today[/minti_button]

Related Posts

Three Elements You Need for a Successful Journey - Element 3

If you’ve ever set off into the wilderness, you know how freeing it can be to have someone there to...

Finding your Financial Focus

Nobody has to be convinced that distracted driving is a bad idea. In 2014, 431,000 were injured in...

Protecting Your Portfolio During a Presidential Election

Throughout our journey, there are so many factors over which we have very little control. Every...