History has shown that over time, small-cap value offers potentially attractive returns. Recent performance shows us that this is a strategy that works over time, not every time.

Value stocks, or those with low relative prices, have outperformed higher-priced growth stocks in the US over the long term.

Similarly, the stocks of smaller companies have fared better than the stocks of bigger ones in the US. But the performance of these stocks has varied at different points in history.

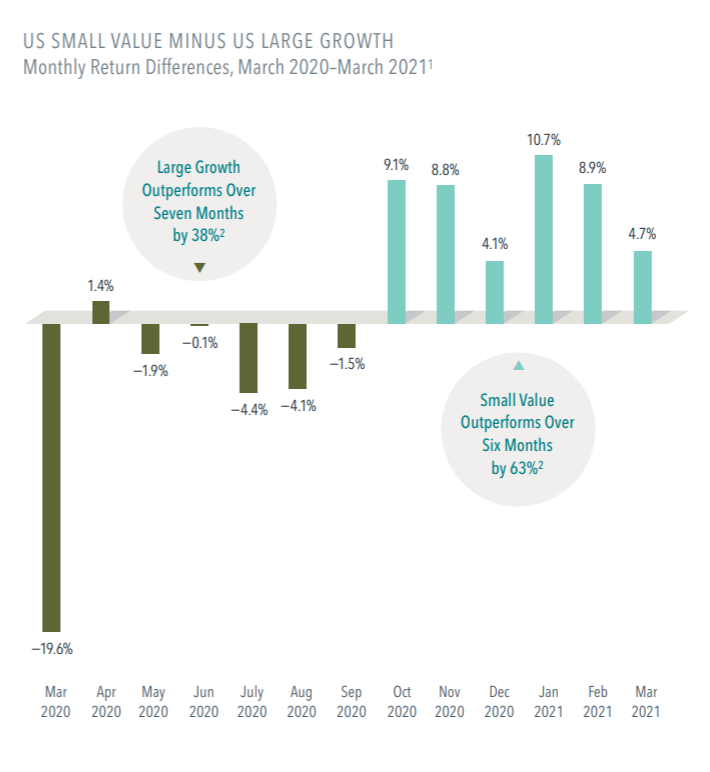

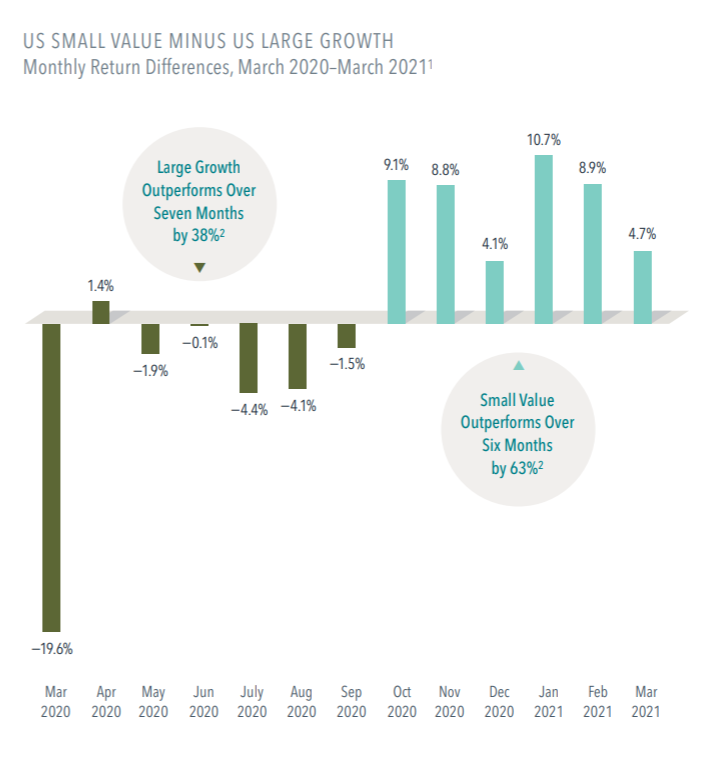

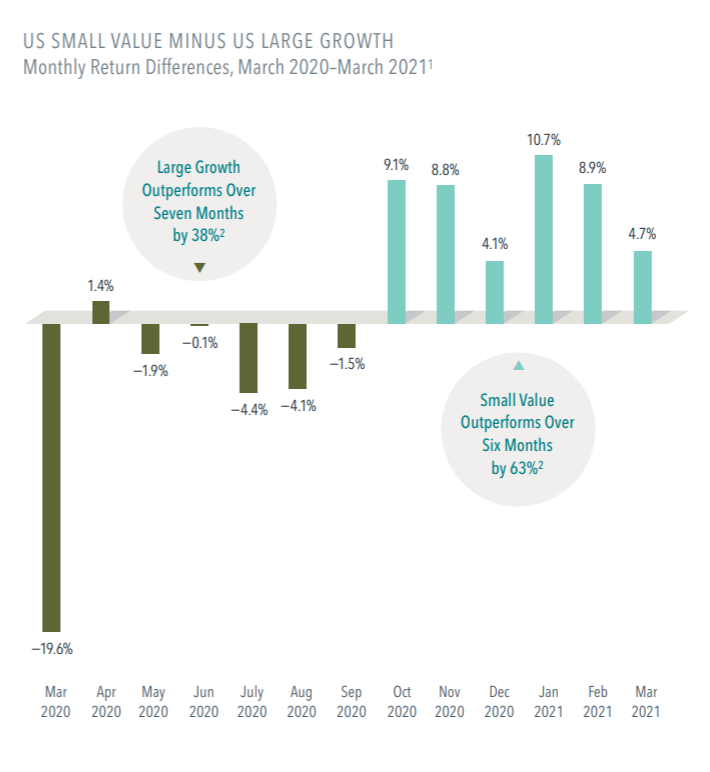

• As the global pandemic rocked markets in March 2020, large growth stocks outdid small value stocks by 19.6%, the greatest monthly margin on record. From March through

September, the large growth index beat small value by a cumulative 38%.

• But history has shown that a disappointing period for a premium can be followed by a quick turnaround, and that’s what happened beginning in October 2020. Through March 2021, the small value index saw its own noteworthy outperformance: 63% over that span, among the best stretches since the 1920s.

History hasn’t presented a reliable way to predict when small value stocks will outperform. Swings can be swift and sharp—staying invested is the best way to capture expected gains over the long term.