5 min read

Rising Interest Rates And Your Retirement

By: Kyle Walters - The Personal CFO on Jun 3, 2022 1:17:17 PM

In March, the US Federal Reserve raised its federal target funds rate by a quarter-point. Although it was the first increase since December 2018, it wasn't a huge surprise. Federal Chairman Jerome Powell had already announced that we could expect multiple rate hikes before the year's end.

But that's not all. Inflation has reached the highest rate we've seen since the early 1980s. Of course, we haven't quite reached the 20% mark that we saw under Federal Reserve Paul Volcker's 1976-1987 tenure, but these are undoubtedly inflationary conditions you likely haven't ever lived through unless you're at least in your 60's.

So with inflation and rising rates in tow, we can't help but ask:

What's An Investor To Do When Interest Rates And Inflation Are Rising?

There are several ways to look at this:

- From the perspective of your finances in the accumulation years.

- From the perspective of your business finances (if you own one).

- From the perspective of a retiree relying on their investments to generate income.

It is only natural to question how rising rates could affect your portfolio returns as a retiree. After all, you're relying on those returns to support your lifestyle. It's also likely you have a healthy allocation to fixed income to keep a comfortable hedge against market volatility in the parts of your portfolio allocated to stock. But should you move out of bonds as rates rise? Lean further into them? Or leave your portfolio alone?

With these questions in mind, I'd like to break down the impact of rising interest rates to explain how they could affect your retirement income.

Bond Values Have An Inverse Relationship To Interest Rates

Some of the most frequently asked questions in a rising rate environment involve bond portfolios and the impact of rising rates. That's because bonds have an inverse relationship to interest rates. When the cost of borrowing money rises (when interest rates rise), bond prices usually fall. When the cost of borrowing money declines, bond prices tend to improve. This is because existing bonds with lower coupon payments must decline in price to be worthwhile investments to potential buyers.

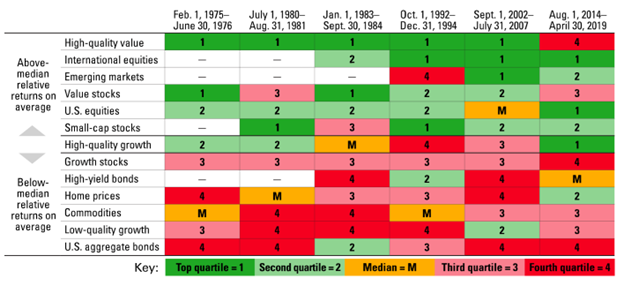

The chart below highlights which asset classes have performed well in rising rate environments and which have not. As you'll see, growth stocks, high-yield bonds, home prices, commodities, low-quality growth, and US aggregate bonds have not done well.

However, you will notice that various equity classes perform well when rates rise, including high-quality value, international equities, emerging markets, value stocks, US equities, and small-cap stocks.

Add Inflation To The Mix, And That Spells Trouble for Bonds

Rising rates aren't the only problem for bonds. With inflation moving higher and bond prices moving lower, bonds are not positioned to outpace inflation, making them a losing proposition. When all else is equal, portfolios heavily allocated to fixed income could become riskier than portfolios with a higher allocation to equities. In our recent article, "Can Reducing Risk Cost You 90% of Your Return?"

Loaners (Bonds) Vs. Owners (Equities)

Even though both stocks and bonds seek to provide you with cash flow in the future, they do so differently, and understanding the difference can safeguard your approach to investing in retirement.

As loans from you to a company or government, bonds are what we refer to as "loaners." There is no equity involved and no shares to buy. When you buy a bond, you lend money to a company or government that promises to pay it back to you over time. The risk here is that the company could go bankrupt during the bond period, in which case you'll stop receiving interest payments and may never recoup your entire principal.

On the other hand, we refer to stocks as "owners." Stocks represent your company's partial ownership, or equity, via shares. The more shares you own, the more of the company you own. When the company grows, so does the value of your shares. The opposite is also true. If it contracts, your shares are worth less.

Right Now, It Pays To Hold "Owners"

Traditionally, bonds have been seen as the less risky asset. That's because they can offer a predictable source of fixed income over time. This is also why the 60 (stocks)/40 (bonds) portfolio worked so well for so long. But with inflation and rising rates on the rise, bonds aren't offering the same hedge against volatility they provided when inflation and interest rates were low. The 60/40 portfolio has become far riskier than it has been over the past forty years.

All in all, rising rates will have a significant impact on the fixed income portion of your portfolio right now, so it may be time to review your holdings.

Diversify Your Sources Of Expected Return

Eliminating an entire asset class from your portfolio is not advised. Bonds and fixed income still have a place in your retirement portfolio. Just be sure you are allocating your portfolio across enough high-returning classes or sources of expected returns to sustain your lifestyle while inflation and rates remain high.

Now is a better time than ever to review what you seek to achieve as an investor and ensure that your portfolio aligns with your goals.

Related Posts

Should You Be Worried About Rising Interest Rates?

After years of low-interest rates, the Fed will be raising rates to combat inflation. Naturally,...

Do We Suffer From Market Volatility Amnesia?

Changes in the price of a stock—also referred to as volatility—can cause a lot of concern,...

Can Reducing Risk Cost You 90% Of Your Return?

The investing experience is an emotional one. From extreme highs when the market is doing well to...