Much like there are different tax brackets for your income, there are also different levels of Medicare premiums. The higher your income in retirement, the more you can expect to pay for Part B and Part D; the health insurance, and the drug benefit portions of Medicare. These increased premiums can feel like a “tax” on your income in retirement.

What is IRMAA?

IRMAA is a monthly surcharge to your Part B and Part D Medicare Plans based on your income level from two years ago. Why two years ago? Because income thresholds are set so late in the year, the IRS uses your tax return from two years ago to determine the “penalty” you will pay. The current tax planning year 2021, for example, will affect your 2023 Medicare costs.

As a well-to-do retiree, you can assume 85% of your social security will be taxed, and you’ll have to foot the bill for surcharges on your Part B and Part D premiums, as well.

Why is IRMAA Considered a Cliff Penalty?

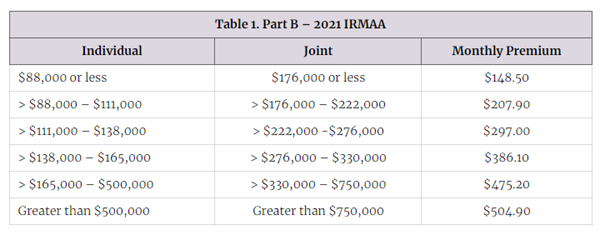

Simply put, IRMAA is considered a cliff penalty because even one dollar over the limit could cost you three to four times more for the same Medicare services. Take a look at the 2021 IRMAA income brackets below.

Source: Centers for Medicare & Medicaid Services (CMS)

If, at age 63, your adjusted gross income (AGI) is $88,000 or less for a single filer or $176,000 as a joint filer, you will pay the baseline Medicare Part B premium of $148.50 per person per month. But, as soon as your income sneaks above those levels, your premiums will increase significantly. As you can see, the premium increases can be very steep.

Note, the table does not include the Medicare Part D (prescriptions) IRMAA, added in 2010 as part of the Affordable Care Act.

The Future of Surcharges is Uncertain

The surcharges you see now were added over time and are constantly evolving, which means there is no way to tell for certain how much IRMAA could affect you five, ten, or fifteen years into retirement.

IRMAA Part B was enacted in 2003, and Part D surcharges were added in 2011. Then in 2019, a new top surcharge tier was added to MAGIs above 500K and 705K. As time goes on, the larger surcharges creep to lower incomes—a trend we can consider likely to continue.

How to Avoid Falling off the IRMAA Cliff

1) Find Ways to Reduce Your MAGI

There are a number of ways to shift or reduce your MAGI in anticipation of your initial IRMAA assessment, which is issued when you first sign up for Medicare and then reissued again every November. The most common strategies include:

-

Funding your Health Savings Account.

-

Completing a Roth conversion in lower-earning years.

-

Delaying social security until age 70.

-

Setting up Qualified Charitable Contributions to reduce your MAGI after age 70.

Of course, IRMAA planning should not be done in isolation but in the overall context of your retirement income plan. The key is understanding where your MAGI aligns with the IRMAA brackets and then finding ways to “exclude” that income from the MAGI calculation.

2) Appeal for Specified Life Events

There may be times in retirement when you anticipate a one-time increase in your income. If this happens, you can file an appeal to have your IRMAA adjusted. Life events that may warrant an appeal include marriage, divorce, the death of a spouse, an income reduction, a loss of income, or loss of a pension. You can also appeal if you suspect the IRS made an error in calculating your MAGI.

3) Plan Ahead

You might think Medicare is something you can put off until your age of eligibility, but the time to start planning is now. At the very least, you should begin a few years before you become eligible for Medicare at age 65. This way you will still have time to try and reduce your MAGI and limit your IRMAA “tax”.

If you missed this window at first and are currently footing high surcharges, though, you’re in luck. There are still ways to mitigate this burden for the years ahead. You simply need some guidance on how best to do so.

Ready to reduce your Medicare costs? Talk to your financial advisor about putting together a plan.